Loading

Get Ca Ftb Schedule Ca (540) 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule CA (540) online

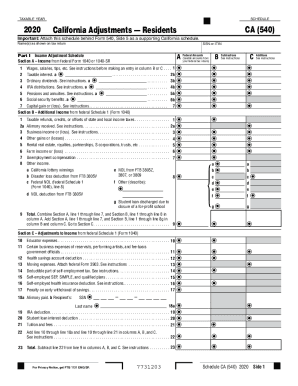

The CA FTB Schedule CA (540) is an essential document for California residents to report income adjustments on their state tax return. This guide provides a clear and supportive approach to filling out this form online, ensuring that users can easily navigate each section and complete it accurately.

Follow the steps to fill out the CA FTB Schedule CA (540) online.

- Use the ‘Get Form’ button to access the Schedule CA (540) and open it in your digital editor.

- In the first section, Part I, input your income from federal Form 1040 or 1040-SR, such as wages or taxable interest. Be careful to follow the instructions before making entries in the designated columns.

- Proceed to Section B where you need to report additional income listed on federal Schedule 1. Enter details like taxable refunds, alimony received, and business income.

- In Section C, make adjustments to your income based on the corresponding fields. This includes educator expenses, health savings account deductions, and penalties for early withdrawal of savings.

- Move on to Part II, which covers adjustments to federal itemized deductions. If you did not itemize for federal purposes but will for California, check the appropriate box.

- Complete the detailed entries under medical and dental expenses, taxes paid, and gifts to charity as applicable.

- After thorough completion of all sections, review your entries for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your CA FTB Schedule CA (540) online today for accurate and efficient filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

CA Adjusted Gross Income (AGI) Your CA AGI can be found on the following lines of your state income tax return (If AGI is a negative number, enter a dash (-) before the amount):

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.