Loading

Get Sc Sc1040tc Worksheet Instructions ] 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SC1040TC Worksheet Instructions online

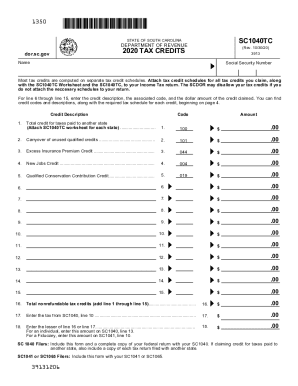

The SC SC1040TC Worksheet Instructions guide South Carolina residents and part-year residents in claiming available tax credits. This document provides a clear, step-by-step approach to filling out the worksheet online, ensuring users can maximize their eligible credits.

Follow the steps to complete the SC SC1040TC Worksheet Instructions effectively.

- Click the 'Get Form' button to access the SC SC1040TC Worksheet Instructions and open it in your online form editor.

- Start by entering your name and Social Security Number at the top of the form. This information is essential for identification purposes.

- For lines 1 through 15 of the form, provide the credit descriptions, corresponding codes, and the amounts for each credit you claim. Be sure to attach any applicable tax credit schedules.

- On line 16, calculate and enter the total nonrefundable tax credits by adding the amounts from lines 1 to 15.

- Enter the tax amount from SC1040, line 10, on line 17.

- On line 18, input the lesser amount between line 16 and line 17. This will be the credit amount applicable to your taxes.

- If you are an SC1040 filer, ensure to include this form along with a complete copy of your federal return when submitting your SC1040. If applicable, add a copy of each state return if claiming credit for taxes paid to other states.

- Once all fields are filled out, review your entries for accuracy. After confirming all information is correct, you can save changes and opt to download, print, or share the form as needed.

Complete your SC SC1040TC Worksheet Instructions online today for accurate tax credit claims.

For single dependents who are under the age of 65 and not blind, you generally must file a federal income tax return if your unearned income (such as from ordinary dividends or taxable interest) was more than $1,050 or if your earned income (such as from wages or salary) was more than $12,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.