Get tax return form 2018 2020-2024

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2019 tax rates online

How to fill out and sign 2018 california pdf online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

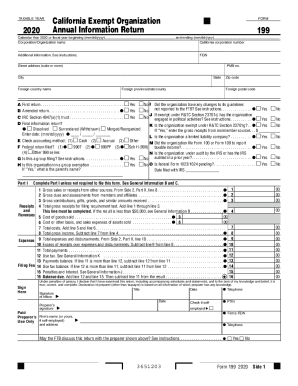

When the tax season started unexpectedly or you just misssed it, it would probably create problems for you. CA FTB 199 is not the easiest one, but you do not have reason for panic in any case.

Making use of our convenient service you will understand the best way to fill up CA FTB 199 even in situations of critical time deficit. You just need to follow these elementary instructions:

-

Open the record with our advanced PDF editor.

-

Fill in all the details required in CA FTB 199, using fillable fields.

-

Insert images, crosses, check and text boxes, if it is supposed.

-

Repeating details will be added automatically after the first input.

-

In case of difficulties, turn on the Wizard Tool. You will receive useful tips for simpler finalization.

-

Never forget to add the date of filing.

-

Make your unique e-signature once and place it in the required places.

-

Check the info you have filled in. Correct mistakes if necessary.

-

Click Done to finish modifying and choose the way you will deliver it. You have the opportunity to use digital fax, USPS or e-mail.

-

It is possible to download the record to print it later or upload it to cloud storage like Google Drive, Dropbox, etc.

With this complete digital solution and its helpful tools, filling out CA FTB 199 becomes more convenient. Do not hesitate to work with it and spend more time on hobbies and interests instead of preparing documents.

How to modify Tax 2019: personalize forms online

Completing papers is more comfortable with smart online instruments. Eliminate paperwork with easily downloadable Tax 2019 templates you can modify online and print.

Preparing papers and paperwork needs to be more accessible, whether it is a day-to-day part of one’s occupation or occasional work. When a person must file a Tax 2019, studying regulations and guides on how to complete a form correctly and what it should include might take a lot of time and effort. Nevertheless, if you find the right Tax 2019 template, finishing a document will stop being a challenge with a smart editor at hand.

Discover a wider selection of features you can add to your document flow routine. No need to print, fill out, and annotate forms manually. With a smart editing platform, all the essential document processing features are always at hand. If you want to make your work process with Tax 2019 forms more efficient, find the template in the catalog, click on it, and see a less complicated way to fill it in.

- If you want to add text in a random area of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you need.

- Use the Highlight tool to stress the main parts of the form. If you want to conceal or remove some text pieces, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic components to it. Use the Circle, Check, and Cross instruments to add these components to the forms, if necessary.

- If you need additional annotations, utilize the Sticky note resource and place as many notes on the forms page as required.

- If the form needs your initials or date, the editor has instruments for that too. Reduce the chance of errors by using the Initials and Date tools.

- It is also possible to add custom graphic components to the form. Use the Arrow, Line, and Draw instruments to customize the document.

The more instruments you are familiar with, the easier it is to work with Tax 2019. Try the solution that offers everything necessary to find and modify forms in one tab of your browser and forget about manual paperwork.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing tax rates 2018

Don’t waste your time — watch our short video guide to figure out how to fill in the 2018 california. A few minutes, a few simple steps, and everything gets done.

Wwwxx 2018 tax returns FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to tax rates 2019

- ca 2018 form 540 instructions

- california 2020

- 2020 california

- ca 2020

- 2019 california

- 2018 tax rates

- wwwxx 2018 tax return

- 2018 ca form 199 instructions

- ca 2018 minimum wage

- 2018 form 199

- california 2012

- ca 2018

- wwwxx 2018 tax returns pdf

- form 199 instructions 2020

- tax form 2019

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.