Loading

Get Ut Ustc Tc-20 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-20 online

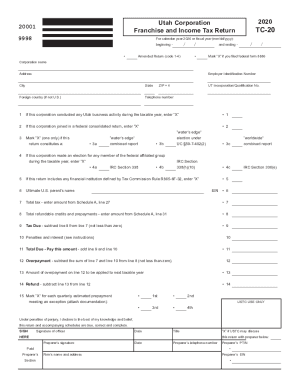

Filling out the UT USTC TC-20 is an essential task for corporations operating in Utah to accurately report their franchise and income tax returns. This guide provides clear, step-by-step instructions to assist users in completing the form effectively.

Follow the steps to complete the UT USTC TC-20 online

- Click ‘Get Form’ button to obtain the UT USTC TC-20 form and open it in your browser.

- Begin by entering the corporation's name and address, including the Employer Identification Number (EIN). Ensure that the information is accurate.

- Indicate the tax year by filling in the beginning and ending date in the mm/dd/yyyy format. Select whether the return is an original or amended return by marking the appropriate box.

- For section 1, mark ‘X’ if the corporation conducted any Utah business activity during the taxable year.

- Complete section 2 by marking ‘X’ if the corporation is part of a federal consolidated return.

- In section 3, select the type of combined report applicable by marking ‘X’ in the appropriate box; options include 'water’s edge', 'worldwide', or if applicable, indicate any elections made.

- Proceed to fill out the financial data: enter the total tax, refundable credits and prepayments, penalties and interest according to the details provided in Schedule A.

- Sign and date the return, ensuring that an authorized officer or the preparer has completed the certification under penalties of perjury.

- Finally, review the form for accuracy, then save, download, print, or share the completed form as required.

Complete your UT USTC TC-20 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Idaho sales tax law says contractors are the consumers (end users) of all the goods they use. As a result, they must pay sales tax on all purchases, including all the equipment, tools, and supplies they use to build, improve, repair, or alter real property.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.