Get Ut Tc-737 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-737 online

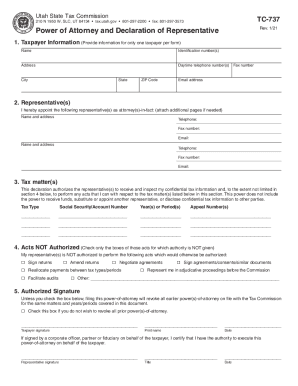

The UT TC-737 form is a Power of Attorney and Declaration of Representative used by taxpayers to designate a representative for handling tax matters. Filling out this form correctly ensures that your chosen representative can manage your tax information and respond to inquiries on your behalf.

Follow the steps to complete the UT TC-737 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the Taxpayer Information section, provide your name, identification number(s), address, daytime telephone number(s), fax number, city, state, ZIP code, and email address. Ensure all information is accurate.

- In the Representative(s) section, appoint your representative(s) by providing their name and address, telephone, fax number, and email. You may attach additional pages if you have more than one representative.

- In the Tax matter(s) section, list the type of tax, social security/account number, and the relevant year(s) or period(s) for which you authorize your representative. Include any appeal numbers if applicable.

- In the Acts NOT Authorized section, check only the boxes for acts you do not authorize your representative(s) to perform. This may include actions like signing returns or negotiating agreements.

- For the Authorized Signature section, sign and date the form. If you are signing on behalf of a corporation or as a partner or fiduciary, indicate your title and ensure you have the authority to execute the document.

- Once you have completed the form, you can save changes, download, print, or share the document as needed.

Complete your UT TC-737 form online today!

Exemption from Utah Income Tax Qualified Exempt Taxpayer. If your federal adjusted gross income is less than or equal to your federal standard deduction, you are exempt from Utah income tax. For this purpose, the federal standard deduction does not include the extra deductions for age or blindness.

Fill UT TC-737

This declaration authorizes the representative(s) to receive and inspect my confidential tax information and, to the extent not limited in. A Utah tax power of attorney (Form TC-737) allows an agent to handle tax-related matters on behalf of a Utah taxpayer. A Utah tax power of attorney (Form TC737) is a legal document between a taxpayer and their representative authorized to handle their taxes. Form TC-737—Power of Attorney and Declaration of Representative. Form TC-559_Payement Coupon for Utah Corporation Franchise. Please note: Processing this application takes 5-10 days.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.