Loading

Get Ut Tc-69c 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-69C online

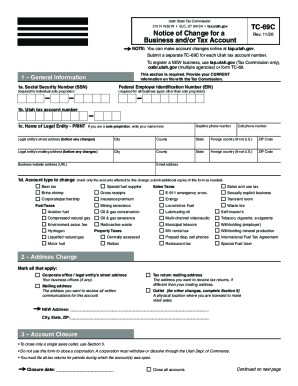

Filling out the UT TC-69C form is essential for reporting changes to your business or tax account with the Utah State Tax Commission. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the UT TC-69C form.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Section 1, enter your general information. Fill out the required fields including your Social Security Number or Federal Employer Identification Number, Utah tax account number, and your legal entity's name. Make sure to provide your current contact numbers, addresses, and business website as well.

- Move to Section 2 to indicate any address changes. Check the appropriate boxes for the type of address you are updating, and provide the new address details.

- If you need to close an account or a sales outlet, navigate to Section 3. Specify the closure date and check the option to close all accounts if applicable. Note that you cannot use this form to close a corporation.

- Proceed to Section 4 to report any other account changes. Provide information for new phone numbers, email addresses, and any changes in business name or details of officers or owners as required.

- For any outlet changes, go to Section 5. Provide the current street address and closure details of the sales tax outlet if applicable. Complete additional sheets if reporting multiple outlet changes.

- Finally, in Section 6, authorize the application by signing and dating the form. Remember that the form will not be processed without a proper signature.

- Review your entries to ensure all information is accurate. Save the changes, and you have the option to download, print, or share the completed form as needed.

Start filling out the UT TC-69C online today for a smoother document management experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The state of Utah has a single personal income tax, with a flat rate of 4.95%. According to the Tax Foundation, total state income tax collections in Utah average $981 per person. This is the 25th highest in the country. Sales taxes in Utah range from 5.95% to 8.60%, depending on local rates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.