Loading

Get Wi D-101a 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI D-101A online

This guide provides comprehensive instructions on how to accurately complete the WI D-101A form online for estimating income tax payments. Whether you are familiar with tax filings or new to the process, this step-by-step guide aims to simplify the task and ensure compliance.

Follow the steps to fill out the WI D-101A online effectively.

- Click ‘Get Form’ button to access the WI D-101A online and open it in your preferred editor.

- Begin by entering personal information, including your name, address, and social security number. Ensure that all details are accurate to avoid any processing delays.

- Complete the income estimation section. Use your previous year's tax return as a reference to fill in the expected Wisconsin income for the current year.

- Fill out the standard deduction and exemption fields. Refer to the provided schedules to correctly input the amounts applicable to your filing status.

- Calculate your estimated taxable income by subtracting the deductions from your total income entered in the previous step.

- Determine your estimated tax liability by applying the appropriate tax rate from the 2020 tax rate schedules provided.

- Subtract any estimated tax credits from the calculated tax to find your required payment.

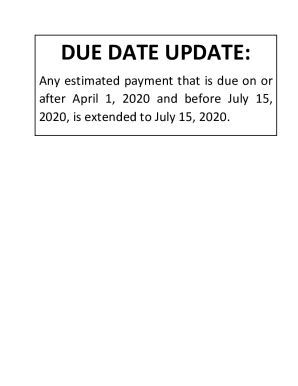

- Break down the total estimated payment into installments. The form will indicate if you have multiple payment dates or if a single payment is required.

- Review all entries for accuracy. Ensure that no sections are left incomplete and that all mathematical calculations are correct.

- Once completed, save your changes and prepare to either download, print, or share the form as required for submission.

Start completing your WI D-101A form online today to stay on top of your estimated tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you owe taxes, however, things can get expensive quickly. If you don't file your return or an extension by the April 15 deadline, you'll be charged a late filing penalty of 5% of the taxes owed for each month, or part of a month, that your return is late, up to a maximum of 25%.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.