Loading

Get Md Comptroller Cra 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller CRA online

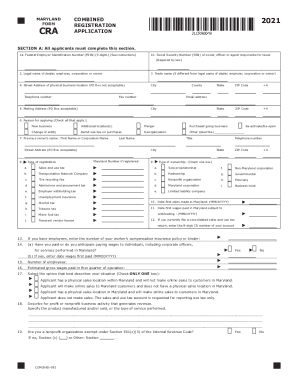

Filling out the Maryland Comptroller Combined Registration Application (CRA) is an essential process for businesses in the state seeking to register for various tax accounts. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring that you can navigate the process smoothly and efficiently.

Follow the steps to accurately complete your application

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Section A, which is mandatory for all applicants. Enter the Federal Employer Identification Number (FEIN) if applicable, then provide the Social Security Number (SSN) of the owner, officer, or agent responsible for taxes as required by law. Continue by entering the legal name of your business or organization.

- Input the trade name if it differs from the legal name, followed by the street address of the physical business location. Make sure to include the city, county, telephone number, and fax number.

- Provide a mailing address, which can be a P.O. Box, along with the corresponding state and ZIP code. Include an email address for correspondence.

- In Section A, item 6, check all reasons for applying that are relevant to your situation, including options like new business, additional location, or change of entity, and provide any necessary descriptions.

- Continue to fill out any previous owner's information, if necessary, including their name and street address, and indicate their Maryland registration number if registered.

- Specify the type of ownership by checking the appropriate box and enter the date first sales were made in Maryland.

- Complete all relevant fields in each section, including additional requirements based on your business type, such as if you plan to sell alcohol, tobacco, or fuels.

- Once you have filled all applicable sections, review the application for completeness and accuracy.

- Finally, save your changes, download your completed application, and print or share it as necessary.

Complete your MD Comptroller CRA online today to ensure your business is properly registered.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A nonresident tax on the sale of Maryland property is withheld at the rate of 8% (2.25% plus the top state tax rate of 5.75%) for individuals and 8.25% on nonresident entities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.