Loading

Get Irs 1040-ss 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-SS online

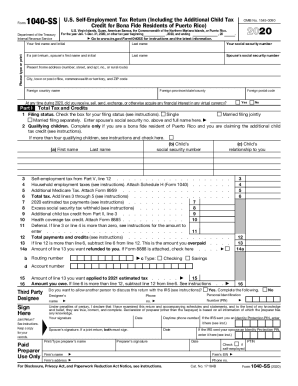

The IRS 1040-SS form is used by self-employed individuals in U.S. territories, including Puerto Rico, to report their income and calculate self-employment tax. This guide provides a user-friendly approach to completing the form online, ensuring that you capture all necessary information accurately.

Follow the steps to fill out the IRS 1040-SS online.

- Press the ‘Get Form’ button to obtain the IRS 1040-SS form and open it in your preferred editing tool.

- Enter your first name, initial, last name, and social security number in the provided fields. If applicable, include your spouse's details if filing jointly.

- Complete your present home address, including any necessary details such as city, territory or commonwealth, and postal code.

- Answer the question regarding virtual currency by selecting yes or no, based on your financial activities during the tax year.

- In Part I, choose your filing status by checking the appropriate box, and if you have qualifying children for an additional child tax credit, list their names, relationships, and social security numbers.

- In Part II, if applicable, report income derived from sources within Puerto Rico and calculate the additional child tax credit.

- Complete Part III if you are reporting profit or loss from farming activities, including details about income and expenses.

- If reporting income from business (sole proprietorship), fill out Part IV, providing details of the income and expenses related to your business operations.

- In Part V, calculate your self-employment tax based on the information from Parts III and IV, ensuring you follow all necessary instructions.

- Review all entries for accuracy, save your changes, and prepare to print, download, or share the completed form as needed.

Start completing your IRS 1040-SS online today to ensure timely filing and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can fold your return to put it in an envelope. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2's or any 1099's. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS received the return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.