Loading

Get Fl Rt-7 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL RT-7 online

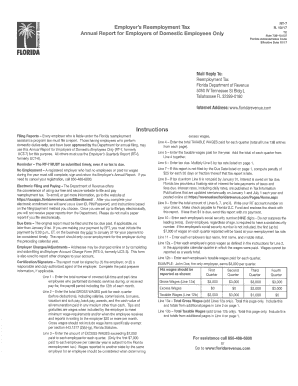

Filling out the FL RT-7 form online can streamline the process of completing important documentation. This guide offers clear and concise instructions to help you navigate each section of the form easily and effectively.

Follow the steps to successfully complete the FL RT-7

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form's introductory section carefully to understand its purpose and scope. Familiarizing yourself with the form's intent will help you provide the necessary information accurately.

- Fill in your personal information in the designated fields. Ensure that your name, address, and contact details are correctly entered to avoid any delays.

- Complete the section related to the details of the case or situation requiring the FL RT-7. Provide specific, relevant information to ensure clarity.

- If applicable, add any supporting documents or notes in the designated area. Make sure to clearly reference these documents within the form where necessary.

- Review all entries for accuracy and completeness before proceeding. Ensure that all required fields are filled out and that the information is consistent.

- Once you have filled out and reviewed the form, save changes, download, print, or share the completed FL RT-7 form as needed.

Take the first step towards efficient document management by completing your forms online.

Related links form

The RT-6 form in Florida is used for reporting reemployment tax and is a key document for employers. This form helps ensure that businesses fulfill their reemployment tax obligations on a quarterly basis. Completing the RT-6 accurately is crucial for avoiding penalties and maintaining eligibility for the state's reemployment services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.