Loading

Get Hi Dot Cm-2b 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT CM-2B online

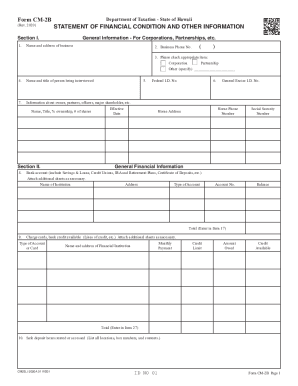

This guide provides clear and detailed instructions on filling out the HI DoT CM-2B online, ensuring users can complete the form accurately. Each component will be explained systematically to cater to users without extensive experience in legal documentation.

Follow the steps to successfully fill out the HI DoT CM-2B online.

- Click ‘Get Form’ button to obtain the HI DoT CM-2B and open it in your preferred online editor.

- In Section I, provide the name and address of the business. Ensure you include any applicable additional information as required for clarity.

- Enter the name and title of the person being interviewed in the designated fields. This should be someone knowledgeable about the business operations.

- Fill in details about the owner, partners, officers, and major shareholders, noting their names, titles, ownership percentages, and number of shares as indicated.

- Complete the business phone number, checking each digit for accuracy.

- Select the appropriate item for your business structure; options include Corporation, Partnership, or Other. Provide the Federal I.D. number and the General Excise I.D. number.

- Provide details about financial accounts such as bank accounts, credit cards, and any safe deposit boxes. Information should include the institution's name, address, account types, and balances.

- Detail any real and lease properties, life insurance policies, and securities. Attach additional sheets if necessary to accommodate all information.

- Complete the Asset and Liability Analysis by listing all assets and liabilities, including their current market values and monthly payments, in the appropriate sections.

- Provide your income and expense analysis for the specified periods, ensuring to include all sources and amounts accurately.

- Review your completed form for any errors or omissions. Make necessary corrections to ensure accuracy of the information provided.

- Once satisfied, save changes to the form. You can then download, print, or share your completed HI DoT CM-2B.

Get started with your HI DoT CM-2B form online today!

Related links form

How 2019 Sales taxes are calculated in Hawaii. The state general sales tax rate of Hawaii is 4%. Hawaii cities and/or municipalities don't have a city sales tax. Every 2019 combined rates mentioned above are the results of Hawaii state rate (4%), the county rate (0% to 0.5%).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.