Loading

Get Nj Nj-1040 Schedule Nj-dop 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040 Schedule NJ-DOP online

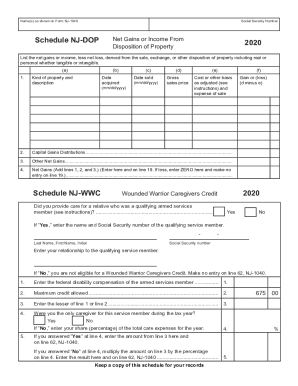

Filling out the NJ NJ-1040 Schedule NJ-DOP is an important step in reporting net gains or income from property dispositions. This guide will provide you with clear and concise instructions to complete this form online, ensuring you accurately report your financial information.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as shown on Form NJ-1040 and include your Social Security number to identify your submission.

- For the section labeled 'Net Gains or Income From Disposition of Property', list the details of each property you disposed of. Fill in the kind of property and provide a brief description.

- Next, enter the date you acquired the property and the date it was sold, ensuring the dates are formatted as MM/DD/YYYY.

- In the following fields, input the gross sales price obtained from the sale and the cost or other basis adjusted according to the guidelines provided in the instructions.

- If applicable, include capital gains distributions in the designated section, ensuring you accurately report your earnings.

- For additional net gains, make sure to record any other income sources that may apply to your situation.

- Once you have filled in all relevant fields, add the totals from lines 1, 2, and 3. If you experience a loss, enter ZERO here and refrain from making any entry on line 19.

- Finally, review the entire form for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your documents online for a smoother filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Any person who became a resident of New Jersey or moved out of this State during the year, and whose income from all sources for the entire year is greater than $7,500 ($3,750 for married persons filing separately), must file a resident return and report that portion of the income received while a resident of New ...

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.