Loading

Get Ny It-201-i 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

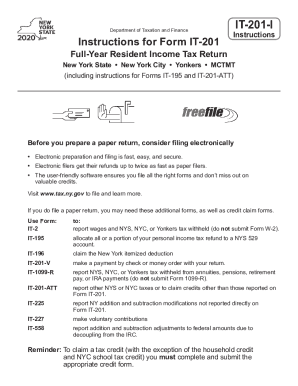

How to fill out the NY IT-201-I online

This guide provides detailed, step-by-step instructions for completing the NY IT-201-I online form. Designed to be user-friendly, this resource supports individuals with varying levels of experience in tax preparation.

Follow the steps to effectively fill out your NY IT-201-I form.

- Click the ‘Get Form’ button to access the electronic version of the NY IT-201-I form, which will open the form in your selected online editor.

- Begin by entering your personal information in the taxpayer information section. This includes your name, address, Social Security number, and date of birth.

- Select your filing status from the options provided, ensuring it matches your federal tax return status.

- Record your federal income and necessary adjustments. This information is crucial for accurately computing your New York State tax obligations.

- Calculate your New York additions and subtractions based on specific criteria set forth by the New York State tax regulations.

- Decide whether to take the New York standard deduction or to use itemized deductions. Be sure to submit necessary documentation if choosing itemized deductions.

- Enter any applicable tax credits you are claiming. Ensure that all required forms related to each credit are attached.

- Review and confirm all entries for accuracy, ensuring that you have completed each section of the form correctly.

- Once all details have been entered and reviewed, proceed to save your changes. You can then choose to download, print, or share the completed form.

Complete your NY IT-201-I form online today for a quicker processing and potential refund.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Those who are married and filing joint returns qualify on incomes up to $21,600 as of 2018. The next tax bracket jumps to 3.534 percent, then to 3.591 percent, then to 3.648 percent.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.