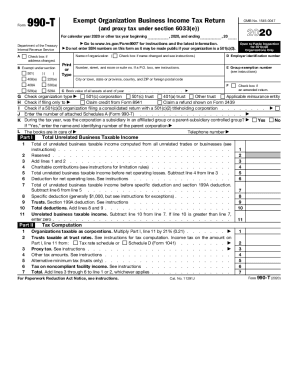

Get Irs 990-t 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990-T online

How to fill out and sign IRS 990-T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If people aren?t connected to document administration and legal operations, submitting IRS forms can be quite hard. We fully grasp the significance of correctly completing documents. Our service proposes the perfect solution to make the mechanism of filing IRS docs as elementary as possible. Follow these tips to accurately and quickly fill out IRS 990-T.

How to submit the IRS 990-T on the Internet:

-

Select the button Get Form to open it and start modifying.

-

Fill out all necessary lines in your file with our advanced PDF editor. Turn the Wizard Tool on to complete the procedure much easier.

-

Make sure about the correctness of added information.

-

Add the date of finishing IRS 990-T. Utilize the Sign Tool to create a special signature for the record legalization.

-

Complete editing by clicking on Done.

-

Send this document to the IRS in the easiest way for you: via email, with virtual fax or postal service.

-

You have a possibility to print it on paper if a copy is required and download or save it to the preferred cloud storage.

Making use of our online software can certainly make expert filling IRS 990-T possible. make everything for your comfortable and secure work.

How to edit IRS 990-T: customize forms online

Forget a traditional paper-based way of executing IRS 990-T. Have the form completed and certified in no time with our top-notch online editor.

Are you forced to edit and fill out IRS 990-T? With a robust editor like ours, you can perform this task in only minutes without the need to print and scan documents back and forth. We provide you with completely editable and simple form templates that will become a starting point and help you fill out the necessary form online.

All forms, automatically, come with fillable fields you can complete once you open the template. However, if you need to polish the existing content of the document or add a new one, you can choose from a number of editing and annotation tools. Highlight, blackout, and comment on the text; include checkmarks, lines, text boxes, images and notes, and comments. Additionally, you can quickly certify the template with a legally-binding signature. The completed document can be shared with others, stored, sent to external programs, or transformed into any popular format.

You’ll never go wrong by choosing our web-based solution to complete IRS 990-T because it's:

- Easy to set up and use, even for users who haven’t completed the documents online in the past.

- Robust enough to allow for various editing needs and form types.

- Safe and secure, making your editing experience protected every time.

- Available across various operating systems, making it effortless to complete the form from anywhere.

- Capable of creating forms based on ready-made templates.

- Compatible with various document formats: PDF, DOC, DOCX, PPT and JPEG etc.

Don't spend time completing your IRS 990-T obsolete way - with pen and paper. Use our full-featured tool instead. It offers you a versatile set of editing tools, built-in eSignature capabilities, and convenience. What makes it stand out is the team collaboration capabilities - you can work together on forms with anyone, create a well-structured document approval workflow from A to Z, and a lot more. Try our online tool and get the best bang for your buck!

Get form

Most charitable nonprofits that are recognized as tax-exempt have an obligation to file an annual information return with the IRS. ... See information on required state filings. Most small tax-exempt organizations with gross receipts that are normally $50,000 or less must file the IRS form 990-N, known as the "e-postcard".

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.