Get Irs Publication 915 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Publication 915 online

This guide provides clear and comprehensive instructions for completing IRS Publication 915 online, a critical resource for reporting the tax implications of social security and equivalent railroad retirement benefits. Whether you are filing your taxes for the first time or looking for specific information, this guide is designed to help you navigate each section efficiently.

Follow the steps to fill out IRS Publication 915 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introduction section to understand the purpose of IRS Publication 915 and its relevance to your tax situation.

- In the first section, ensure you enter your personal information as required, including your name and social security number, as they are essential for proper identification.

- Proceed to the area that asks about your benefits. Here, clearly indicate whether any of your social security or railroad retirement benefits are taxable.

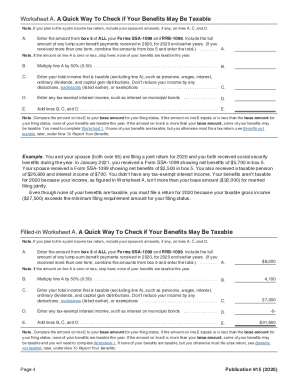

- Use the provided worksheets to assist in calculating your taxable benefits. This includes comparing your total income to the base amount relevant to your filing status.

- If applicable, fill out the sections regarding lump-sum elections or repayments, providing detailed information based on past benefits and repayments.

- Review all inputted data to ensure accuracy, as incorrect information can delay processing.

- Once completed, you can save your changes. Choose the options to download, print, or share your filled-out form as needed.

Start preparing your documents online to ensure a smooth filing process!

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free. However, if you're still working, part of your benefits might be subject to taxation. The IRS adds the figures for your earnings and half your Social Security benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.