Loading

Get Irs Instruction 1120s - Schedule K-1 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1120S - Schedule K-1 online

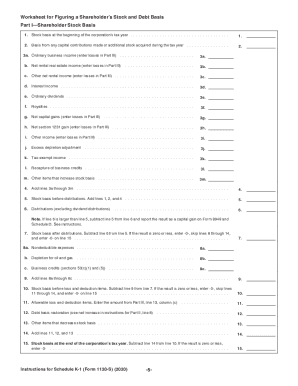

Filling out the IRS Instruction 1120S - Schedule K-1 can be a straightforward process when approached methodically. This guide provides comprehensive, step-by-step instructions to assist users in accurately completing this essential document online.

Follow the steps to navigate and complete the IRS Schedule K-1 form.

- Click ‘Get Form’ button to obtain the Schedule K-1 form and open it in the digital document management platform.

- Identify your section of the Schedule K-1, which primarily reports your share of the corporation's income, deductions, and credits. Carefully review the instructions provided to understand the necessary details to include.

- In Box 1, enter the ordinary business income or loss, as applicable. This figure should reflect your share of the corporation's income or losses from trade or business activities.

- In Box 2, input your net rental real estate income or loss. This entry must reflect whether you materially participated in the rental activity to determine if it’s passive or active.

- Proceed through the remaining boxes (Boxes 3-19) to fill out details pertaining to other income, credits, deductions, and items affecting your basis. Make sure to consult the codes and descriptions provided for each box to select appropriate entries.

- Once all relevant boxes are completed, cross-check the information with the instructions to ensure accuracy and completeness.

- Upon finishing your entries, choose to save the form, download it for printing, or share it electronically with your tax professional or the IRS as needed.

Complete your IRS Schedule K-1 online today and ensure your tax filings are accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Enter any interest income on the K-1 form line 1 on line 8a of the 1040 form. Ordinary dividends on line 2a of the form are entered on line 9a on the 1040 form. Amounts on line 2b of the K-1 form are entered on line 9b on the 1040.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.