Loading

Get Fl Dr-501ts 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-501TS online

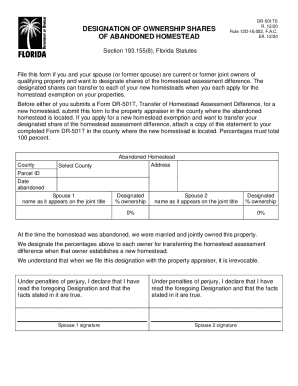

The FL DR-501TS form, known as the Designation of Ownership Shares of Abandoned Homestead, is essential for couples looking to designate shares of their homestead assessment difference. This guide provides clear steps for successfully filling out the form online, ensuring a smooth experience.

Follow the steps to complete the FL DR-501TS form online.

- Click 'Get Form' button to access the form and open it in your chosen online editor.

- Begin by selecting the county where the abandoned homestead is located. Use the drop-down menu to ensure the correct county is identified.

- Enter the address of the abandoned homestead in the appropriate field. Ensure that the information is accurate to avoid any issues during processing.

- Provide the Parcel ID for the property. This number is unique to the property and can typically be found on the property tax bill.

- Enter the date the homestead was abandoned in the designated field. This date is critical for establishing timelines for the homestead assessment difference.

- In the section for Spouse 1, enter their name as it appears on the joint title. Below their name, specify the designated percentage of ownership.

- Repeat the process for Spouse 2, entering their name and designated percentage of ownership. The combined percentages must equal 100 percent.

- Review the statement acknowledging that both spouses were married and jointly owned the property at the time of abandonment. Confirm your understanding that the designation is irrevocable.

- Both spouses must sign where indicated to declare the information as true under penalties of perjury.

- After completing the form, save your changes, download, print, or share the form as required. Ensure you attach a copy when submitting Form DR-501T for a new homestead.

Complete your FL DR-501TS form online today for a seamless filing experience.

Related links form

Businesses don't directly pay sales tax on products and services they sell. ... Merchants in most states are required to collect sales tax and pay it to the state department of revenue. Specific products and services are sales-tax eligible, depending on state laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.