Get Ca Cdtfa-146-res (formerly Boe-146-res) 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CDTFA-146-RES (Formerly BOE-146-RES) online

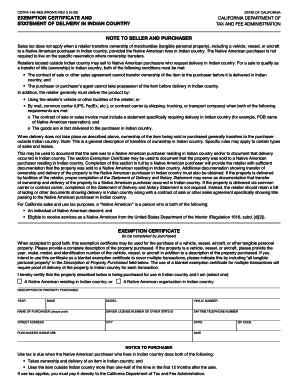

This guide provides detailed instructions for completing the CA CDTFA-146-RES form online. Designed for users at all experience levels, these steps will ensure you accurately fill out the form to document sales tax exemptions for Native American purchasers in Indian country.

Follow the steps to fill out the CA CDTFA-146-RES form online confidently.

- Click the ‘Get Form’ button to download the CA CDTFA-146-RES form and open it in your preferred editor.

- Begin by completing the 'Exemption Certificate' section. Indicate whether you are a Native American residing in Indian country or a Native American organization.

- Provide a complete description of the property being purchased in the 'Description of Property Purchased' field, including year, make, model, and identification number if applicable.

- Fill in your personal details, including your name, driver license number or other state ID, daytime telephone number, street address, city, state, and ZIP code.

- Sign and date the form where indicated to certify that the information is accurate.

- For the 'Statement of Delivery' section, the seller must complete the relevant fields, including details of the merchandise and delivery information.

- If applicable, complete the 'Notary Statement' section to have the document notarized, confirming the identity of the signer.

- Review the form for accuracy, then save your changes. You may choose to download, print, or share the completed form.

Complete your documents online today to ensure compliance and accuracy.

Indian reservation gambling generates more income than Atlantic City and Las Vegas combined. In 2009, this totaled $26.5 billion in revenue from 425 facilities, run by 233 tribes in 28 states. Tribes receive $4 of every $10 that Americans wager at casinos.

Fill CA CDTFA-146-RES (Formerly BOE-146-RES)

Sales tax does not apply when a retailer transfers ownership of merchandise (tangible personal property), including a vehicle, vessel, or aircraft. • CDTFA-146-RES, Exemption Certificate and Statement of Delivery in Indian Country. For California sales and use tax purposes, an "Indian" is a person who is both of the following: • An individual of American Indian descent, and. ❤. CDTFA-146-TSG (FRONT) REV.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.