Loading

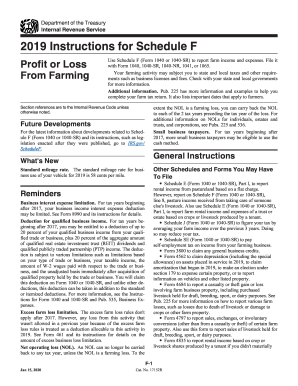

Get Irs 1040 Schedule F Instructions 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule F Instructions online

This guide provides a comprehensive, step-by-step approach to filling out the IRS 1040 Schedule F Instructions online. Whether you are a seasoned farmer or new to farming activities, these instructions aim to support you as you navigate the process of reporting farm income and expenses.

Follow the steps to successfully complete your IRS 1040 Schedule F

- Press the ‘Get Form’ button to access the IRS 1040 Schedule F and open it in your chosen editing tool.

- Carefully read the general instructions provided on the form to understand the overview of what the form entails and the definitions of terms.

- Locate Line B on the form and enter one of the 14 principal agricultural activity codes that best describes your farming business.

- Choose the accounting method you are using (cash or accrual) on Line C and check the corresponding box.

- For Line D, input your employer identification number (EIN) as required. If you do not have an EIN, leave it blank.

- Fill out Part I by entering your farm income. Report all cash or property received as part of your farming operations on the respective lines.

- In Part II, list your farm expenses. Provide the total for each category of expense and ensure that you separate personal expenses from business-related costs.

- Upon completing all required sections, review the form for accuracy, ensuring that all entries are correct and complete.

- Finally, save your changes, download the completed form, print it, or share it as needed for your records or submission.

To ensure a smooth filing process, complete your IRS documents online using these detailed instructions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

It is also considered a farm when crops and plants can be planted on it. ... "A farm is an area of land, or, for aquaculture, lake, river or sea, including various structures, devoted primarily to the practice of producing and managing food (produce, grains, or livestock), fibres and, increasingly, fuel.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.