Get Irs 9465 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 9465 online

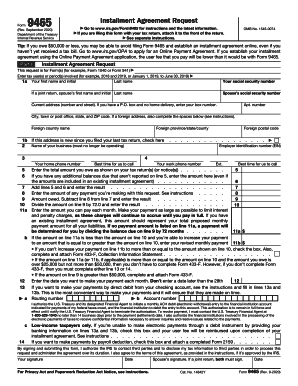

Filling out the IRS 9465 form online can be a straightforward process if you follow the necessary steps carefully. This form, known as the Installment Agreement Request, allows users to request a payment plan for their tax liabilities.

Follow the steps to successfully complete the IRS 9465 online.

- Click the ‘Get Form’ button to access the IRS 9465 form and open it in your preferred editing tool.

- Begin by filling out Part I of your Installment Agreement Request. Enter the specific tax forms and years related to your request in the designated fields.

- Provide your personal information. Fill in your last name, first name and initial, social security number, and spouse’s information if applicable.

- Input your current address. If you have a P.O. Box, ensure to specify that information clearly. Check the box if this is a new address since your last tax return.

- Complete the section regarding your business, if necessary, including your employer identification number, home and work phone numbers, and the best times for the IRS to contact you.

- Declare the total amount owed as indicated on your tax returns or notices, and include any additional balances due as applicable.

- Calculate your total balance due by adding the amounts from the previous fields, and determine any payment you are making with this request.

- Enter the amount you propose to pay each month, and indicate the date you wish to make these payments, ensuring it does not exceed the 28th of the month.

- If opting for direct debit payments, fill in your banking information as per instructions provided in the form.

- Review all entries for accuracy, then sign and date the form. If filing jointly, your spouse must also sign.

- Once completed, save your changes, and then download, print, or share the form as required.

Begin completing your IRS 9465 form online now.

Setting up a Payment Plan Now fill out Form 9465, the Installment Agreement Request. You can use the Online Payment Agreement Application on the IRS website if your tax debt is $50,000 or less including interest and penalties. ... You must make your payment by the same day each month.

Fill IRS 9465

By signing and submitting this form, I authorize the IRS to contact third parties and to disclose my tax information to third parties in order to process this. If you are filing Form 9465 separate from your return, refer to the tables below to determine the correct filing address. The 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe. How do I apply for an Installment Agreement?

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.