Loading

Get Irs 990 - Schedule I 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule I online

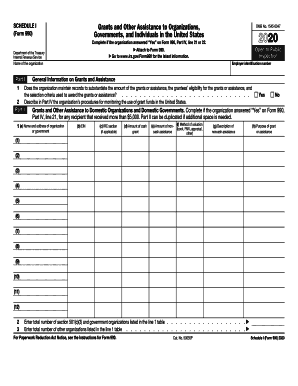

Filling out the IRS 990 - Schedule I is essential for any organization that meets the specific criteria in Form 990. This guide will provide you with clear and detailed steps to help you complete this form online efficiently and accurately.

Follow the steps to complete the IRS 990 - Schedule I online.

- Press the ‘Get Form’ button to download the form and open it in your chosen editor.

- Start with Part I, where you will provide general information on grants and assistance. Indicate whether your organization maintains records to substantiate the amounts and eligibility for grants by answering 'Yes' or 'No.' Provide a description of your monitoring procedures in Part IV.

- Move to Part II if your organization answered 'Yes' to reporting on domestic organizations or governments. Here, list each recipient that received more than $5,000 in grants. For each entry, provide the name, address, employer identification number (EIN), the amount of cash grants, and any noncash assistance.

- Next, complete Part III if you answered 'Yes' regarding domestic individuals. Similar to Part II, specify the type of assistance provided, the number of recipients, and the amounts of cash and noncash assistance. Be detailed in describing the purpose of the assistance.

- Finally, use Part IV to supply any necessary supplemental information, such as further narrative explanations about your procedures or estimation methodologies. Ensure to label the responses according to the specific items they support.

- After completing all parts of the form, you can save your changes, download a copy for your records, print it, or share the completed form with the necessary parties.

Start completing your IRS 990 - Schedule I online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form 8282 Instructions Schedule B 990 (Schedule of Contributors) is used by organizations that are exempt from paying income tax. It is filed in conjunction with Form 990, 990-EZ, or 990-PF and provides the names and addresses of contributors to the organization.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.