Loading

Get Irs W-2as 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

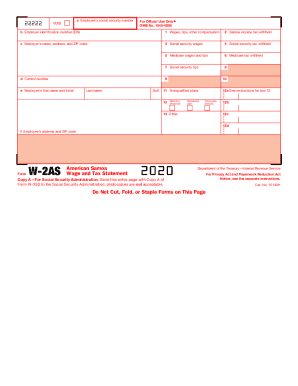

The IRS W-2AS form, also known as the American Samoa Wage and Tax Statement, is an essential document for employees working in American Samoa. This guide provides a clear and supportive overview of how to accurately complete the W-2AS form online.

Follow the steps to complete your W-2AS form online.

- Click ‘Get Form’ button to obtain the form and open it.

- Input the employee's social security number in box a. Ensure this number is accurate to avoid any discrepancies.

- Enter the employer identification number (EIN) in box b, which identifies the employer for tax purposes.

- Provide the employer's name, address, and ZIP code in box c. This information helps identify where the wages are coming from.

- Fill in the total wages, tips, and other compensation received by the employee in box 1.

- Input the amount of Samoa income tax withheld in box 2.

- Complete boxes 3 through 7 with the employee's social security wages, and the respective taxes withheld for social security and Medicare.

- In box 8, if applicable, include any social security tips.

- Enter additional information like control number in box d, and the employee's first name, initial, last name, and suffix in box e.

- Fill out the employee's address and ZIP code in box f.

- Complete boxes 10 through 14 as necessary, including any codes and relevant amounts indicated in the instructions.

- Once all information is filled, review for accuracy. Users can save changes, download, print, or share the completed form.

Complete your IRS W-2AS form online today to ensure accurate reporting of your wages and taxes.

Health Savings Account Change In 2018 Could Trip Up Some Consumers. Money deposited in a health savings account is tax-deductible, grows tax-free and can be used to pay for medical expenses. The annual maximum allowable contribution to an HSA is slightly lower for some people this year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.