Loading

Get Irs 8879-c 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-C online

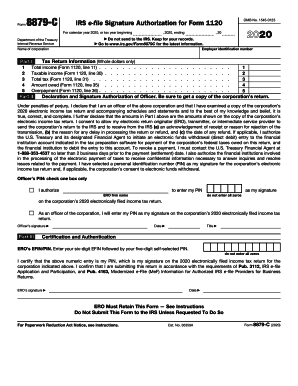

The IRS 8879-C form is an essential document for corporate officers who wish to electronically sign their corporation's income tax return. This guide provides a step-by-step approach to successfully filling out this form online, ensuring a smooth submission process.

Follow the steps to complete the IRS 8879-C online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer identification number and the name of the corporation at the top of the form.

- In Part I, fill in the total income, taxable income, total tax, amount owed, and overpayment as reported on Form 1120, ensuring all entries are whole dollars.

- Proceed to Part II and declare your status as an officer of the corporation. Review the statement to ensure your awareness and agreement with the content.

- Provide your personal identification number (PIN) in the designated area, selecting the appropriate option regarding who will enter the PIN.

- Sign and date the form in the specified fields to validate your authorization for electronic filing.

- Ensure that the electronic return originator (ERO) completes Part III, including their signature and date, and retains this form for their records.

- Once all details are verified, save the changes made to the form. You can download, print, or share it as needed.

Complete your IRS 8879-C form online today for a seamless filing experience.

Order online. Use the 'Get Transcript ' tool available on IRS.gov. ... Order by phone. The number to call is 800-908-9946. Order by mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.