Loading

Get Irs 1120-c 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-C online

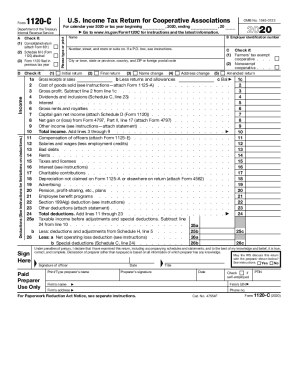

The IRS 1120-C is the U.S. income tax return for cooperative associations. This guide provides detailed instructions on how to complete the form online, ensuring compliance with tax regulations while accommodating users of varying legal knowledge.

Follow the steps to complete your IRS 1120-C accurately.

- Press the ‘Get Form’ button to obtain the IRS 1120-C form and open it in the editor.

- Fill in the cooperative’s name, employer identification number (EIN), and address. Make sure to indicate if this is an initial, final, or amended return as applicable.

- Proceed to report gross receipts or sales in section D, ensuring to deduct returns and allowances correctly.

- Calculate the cost of goods sold and subtract this from the gross receipts to determine gross profit.

- Report dividends, interest, gross rents, and other income sources in the income section. Ensure all applicable lines are filled.

- Proceed to deductions, listing compensation of officers, salaries, rents, and other business expenses. Total these deductions accurately.

- Calculate taxable income by subtracting total deductions from gross income.

- Check applicable boxes such as if the cooperative is a farmers’ tax-exempt cooperative or if any special deductions apply.

- Complete the tax and refundable credits section, including any payments made and overpayments from previous tax filings.

- Review and ensure all sections are complete, then save changes, download, print, or share the completed form as required.

Complete your IRS 1120-C form online today for timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

File Your Federal Tax Return If you're business is an S corporation, you'll file Form 1120S, a tax return that shows your corporation's income, expenses and losses. You'll also file a Form K-1 for each of your corporation's shareholders, showing their share of the corporation's income, deductions and credits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.