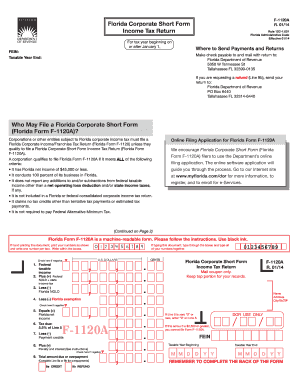

Get Fl F-1120a 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL F-1120A online

How to fill out and sign FL F-1120A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Reporting your income and submitting all the essential tax documents, including FL F-1120A, is the exclusive responsibility of a US citizen.

US Legal Forms simplifies your tax management and enhances precision.

Store your FL F-1120A securely. Ensure that all your accurate documents and information are organized correctly while being mindful of deadlines and tax regulations set by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain FL F-1120A directly in your web browser on your device.

- Click to open the editable PDF.

- Begin completing the online template step by step, following the instructions of the sophisticated PDF editor's interface.

- Carefully enter text and figures.

- Choose the Date field to automatically input the current date or modify it manually.

- Use the Signature Wizard to create your unique electronic signature and validate it quickly.

- Refer to IRS regulations if you have any remaining inquiries.

- Press Done to finalize the modifications.

- Proceed to print the document, save it, or send it via email, text, fax, or postal service without leaving your internet browser.

How to adjust Get FL F-1120A 2014: personalize forms online

Handling documents is simple with intelligent online tools. Remove paperwork with easily accessible Get FL F-1120A 2014 templates that you can adapt online and print out.

Creating documents and paperwork should be more attainable, whether it's a daily aspect of one’s job or occasional tasks. When an individual needs to submit a Get FL F-1120A 2014, understanding regulations and instructions on how to properly complete a form and what it should contain can be time-consuming and demanding. However, if you discover the right Get FL F-1120A 2014 template, filling out a document will cease to be a task with an advanced editor available.

Explore a wider selection of functionalities you can integrate into your document workflow. There is no need to print, fill out, and annotate forms manually. With an advanced editing platform, all necessary document processing capabilities are consistently accessible. If you wish to enhance your workflow with Get FL F-1120A 2014 forms, locate the template in the catalog, select it, and experience a more straightforward method to complete it.

The more tools you are familiar with, the easier it is to handle Get FL F-1120A 2014. Experiment with the solution that offers everything needed to locate and adjust forms in a single tab of your browser and eliminate manual paperwork.

- If you want to insert text in a random part of the form or add a text field, utilize the Text and Text field tools and enlarge the text in the form as needed.

- Use the Highlight tool to emphasize the crucial elements of the form. If you wish to hide or delete certain text sections, make use of the Blackout or Erase tools.

- Personalize the form by including default graphic elements to it. Employ the Circle, Check, and Cross instruments to incorporate these elements into the forms, if necessary.

- If you require extra notes, take advantage of the Sticky note feature and place as many notes on the forms page as necessary.

- If the form necessitates your initials or date, the editor has tools for that as well. Reduce the likelihood of mistakes using the Initials and Date tools.

- It's also straightforward to add custom visual elements to the form. Utilize the Arrow, Line, and Draw tools to modify the document.

Get form

Related links form

Yes, Florida imposes a 5.50 percent corporate income tax on organizations that meet the income requirements. This tax applies to net income earned by the corporation after deductions, and businesses must accurately report this using the FL F-1120A. Staying informed about tax rates ensures that your business budget remains intact.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.