Get Az Transaction Privilege (sales) And Use Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Transaction Privilege (Sales) and Use Tax Return online

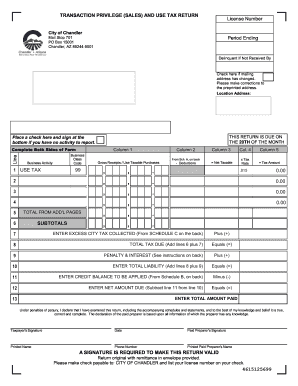

Filing the AZ Transaction Privilege (Sales) and Use Tax Return is essential for businesses operating in Chandler, Arizona. This guide provides comprehensive instructions on completing the form online, ensuring accuracy and compliance with tax requirements.

Follow the steps to accurately complete the tax return.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing platform.

- Begin by entering your license number in the designated field at the top of the form. This number is crucial for identification purposes.

- Fill in the city name, specifically the City of Chandler, and the period ending date for the tax return according to the reporting period.

- Provide your mailing address in the preprinted section. If there are any changes, check the appropriate box and correct the address as needed.

- Indicate your business activity type under the business class code and description section. Make sure to fill in all applicable lines with the required data for each business activity.

- Report gross receipts or use taxable purchases in Column 1, then calculate deductions accordingly. Document any deductions using Schedule A if applicable.

- Compute the net taxable amount by applying the appropriate tax rate to the subtotal of taxable receipts, and record the tax amount due in the corresponding columns.

- If applicable, enter any excess city tax collected in the provided field from Schedule C. Summarize the total tax due by adding any penalties or interest as specified.

- Complete the credit balance section, using totals from Schedule B if any credits exist. This amount will deduct from the total liability.

- Sign the return at the bottom, confirming accuracy under penalties of perjury. Both the taxpayer's and preparer's signatures are essential for validation.

- After completing the form, save your changes, and opt to download, print, or share the document as needed.

Complete your AZ Transaction Privilege (Sales) and Use Tax Return online today to ensure timely and accurate filing.

Related links form

The tax on TPT in Arizona varies depending on the type of business activity. Generally, the rates range from 2.5% to 5.6%, but local jurisdictions may impose additional taxes. Therefore, you should consult the Arizona Department of Revenue to determine the exact rate for your specific business type. Keeping this in mind will ensure your AZ Transaction Privilege (Sales) and Use Tax Return reflects accurate calculations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.