Get Fl Dr-570wf 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DR-570WF online

How to fill out and sign FL DR-570WF online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

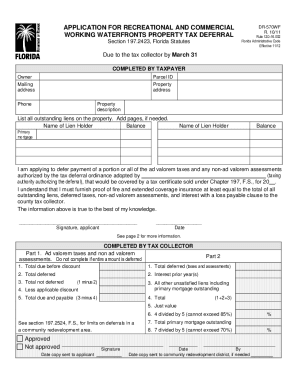

Submitting your income and filing all the essential tax documents, including FL DR-570WF, is the sole duty of a US citizen.

US Legal Forms simplifies your tax management, making it more efficient and precise.

Store your FL DR-570WF securely. Ensure that all your relevant documents and records are correctly arranged while being mindful of the deadlines and tax regulations set by the Internal Revenue Service. Make it easy with US Legal Forms!

- Access FL DR-570WF through your web browser on your device.

- Click to access the editable PDF file.

- Start filling in the online template section by section, adhering to the prompts of the advanced PDF editor's interface.

- Accurately enter text and numerical data.

- Click on the Date field to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to generate your personalized electronic signature and validate in moments.

- Consult the IRS directions if you have any remaining questions.

- Hit Done to finalize the modifications.

- Continue to print the document, download it, or share via email, SMS, fax, or USPS without exiting your web browser.

How to alter Get FL DR-570WF 2011: personalize documents online

Place the appropriate document management features at your disposal. Perform Get FL DR-570WF 2011 with our reliable solution that merges editing and eSignature capabilities.

If you aim to finalize and validate Get FL DR-570WF 2011 online without any hassle, then our online cloud-based solution is the ideal choice. We offer a rich template repository of ready-to-use forms that you can modify and finalize online. Furthermore, you do not need to print the document or rely on third-party tools to make it fillable. All essential functionalities will be instantly available for your use as soon as you access the document in the editor.

Let us explore our online editing features and their primary functionalities. The editor boasts an intuitive interface, ensuring you won't spend much time learning how to utilize it. We will review three key areas that enable you to:

In addition to the functionalities mentioned above, you can secure your document with a password, add a watermark, convert the file to the desired format, and much more.

Our editor simplifies the process of modifying and certifying the Get FL DR-570WF 2011. It allows you to accomplish nearly everything related to handling forms. Additionally, we consistently ensure that your document management experience is safe and compliant with key regulatory standards. All these features enhance your satisfaction with our solution.

Obtain Get FL DR-570WF 2011, implement the required edits and adjustments, and save it in your preferred file format. Give it a try today!

- Alter and annotate the template

- Utilize the top toolbar to emphasize and obscure text, excluding images and visual elements (lines, arrows, and checkmarks, etc.), sign, initial, date the document, and more.

- Organize your documents

- Access the toolbar on the left if you wish to re-arrange the document or eliminate pages.

- Make them shareable

- If you want to create the document fillable for others and distribute it, you can use the tools on the right to add various fillable fields, signature and date fields, text boxes, etc.

Related links form

To fill out a certificate of title in Florida, start by gathering vehicle details such as the VIN, make, model, and year. You must also include buyer and seller information, ensuring everything is accurate. A correctly filled certificate is vital to avoid issues with your FL DR-570WF registration and future transactions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.