Loading

Get Az Privilege Sales Tax Return - Phoenix

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Privilege Sales Tax Return - Phoenix online

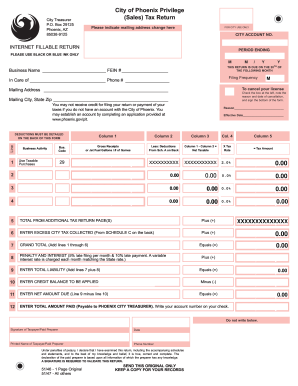

Completing the AZ Privilege Sales Tax Return is an essential process for businesses operating in Phoenix. This guide provides clear, step-by-step instructions for filling out the return online, ensuring you accurately report your tax information.

Follow the steps to successfully complete your tax return online

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling in your business name and Federal Employer Identification Number (FEIN) at the top of the form. Ensure these details are accurate and clearly noted.

- For the main portion of the form, report your gross receipts or applicable gallons/number of games in the specified columns. Be precise to avoid discrepancies.

- Calculate your net taxable amount by subtracting the deductions from your gross receipts.

- Review additional tax returns if applicable and ensure totals from the additional pages are calculated and summarized correctly.

- Complete your total liability, credit balance, and net amount due calculations clearly.

- Once all fields are completed and reviewed, you may save your changes, download the form, print it, or share it as needed.

Complete your AZ Privilege Sales Tax Return online and ensure accurate submission today.

Related links form

Filing a TPT return in Arizona involves completing a form that details your gross income from sales. You can file online through the Arizona Department of Revenue's website or by paper. It’s crucial to adhere to the filing deadlines to avoid penalties. By using services like US Legal Forms, you can streamline the process of preparing your AZ Privilege Sales Tax Return - Phoenix.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.