Loading

Get Az Form 835 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 835 online

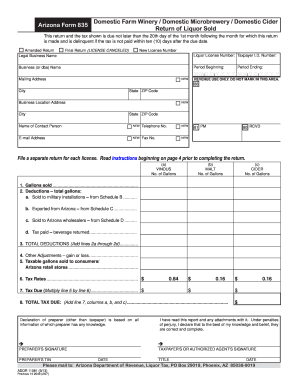

Filling out the AZ Form 835 is essential for domestic farm wineries, microbreweries, and cider producers in Arizona to report the sale of liquor. This guide provides a detailed, step-by-step approach to completing the form online, ensuring you can navigate each section with confidence.

Follow the steps to successfully complete the AZ Form 835 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating whether this is an amended return or a final return, and provide the legal business name. Fill in your liquor license number and taxpayer identification number.

- Enter the period for which you are filing this return by specifying the beginning and ending dates.

- Provide the mailing address and business location address, ensuring each component is filled out accurately, including city, state, and ZIP code.

- Identify the contact person for the business and enter their phone number, email address, and fax number as needed.

- Next, report the number of gallons sold for vinous, malt, and cider liquors in the respective fields provided.

- Enter deductions, including sales to military installations, out-of-state sales, and sales to Arizona wholesalers, referencing the Schedules B, C, and D as necessary.

- Calculate adjustments for any prior month and indicate any tax paid for returned beverages.

- Determine the taxable gallons sold to consumers and retail stores, then apply the relevant tax rates to calculate the total tax due.

- Final steps include verifying all entered information for accuracy, signing the form, and preparing it for submission. You can save changes, download, print, or share the completed form as needed.

Complete your AZ Form 835 online today to ensure timely submissions and compliance with Arizona tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Arizona offers several state withholding forms for employers to report wages and withholdings. The primary form for individuals is often AZ Form 835. Utilizing this form correctly ensures that you meet your withholding obligations effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.