Get Fl Dr-309631n 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-309631N online

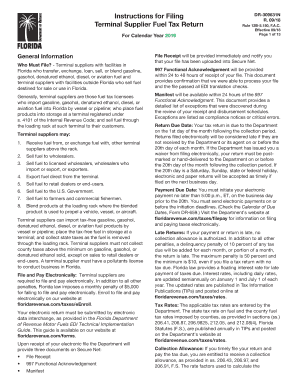

This guide provides a thorough and supportive overview of how to complete the FL DR-309631N form online. Designed for terminal suppliers in Florida, this resource aims to simplify the process of filing your fuel tax return with clear instructions and helpful tips.

Follow the steps to complete your FL DR-309631N online.

- Click ‘Get Form’ button to obtain the FL DR-309631N form and open it in your preferred document editor.

- Carefully review the general information section to ensure you qualify as a terminal supplier required to file this form in Florida.

- Fill out the 'Beginning Physical Inventory' by reporting the inventory of gasoline, undyed diesel fuel, dyed diesel fuel, and aviation fuel in the respective columns.

- Report 'Receipts' by entering the amounts sourced from the related detail schedules, ensuring totals match your records.

- Input 'Disbursements' amounts similarly, making sure to verify with your detailed reports.

- Complete the 'Ending Physical Inventory' line accurately based on the end-of-month totals.

- Calculate and enter any 'Tax-Paid Purchases' based on previous calculations and relevant tax rates.

- Once all fields are filled and verified, save the document, and choose an option to download or print the completed form.

- Ensure to file the form electronically by the specified deadlines and keep copies of the confirmations for your records.

Complete your FL DR-309631N form online today to ensure timely filing and compliance with Florida tax regulations.

Get form

Related links form

To get medical power of attorney for a parent in Florida, you need to create a document that clearly states their healthcare wishes and designate someone you trust to make decisions if necessary. This document must comply with state laws, including the need for signatures from witnesses or notaries. Online resources, like US Legal Forms, can significantly simplify this process by providing you with the necessary templates and guidance for creating a valid medical power of attorney.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.