Loading

Get Fl Dr-185 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-185 online

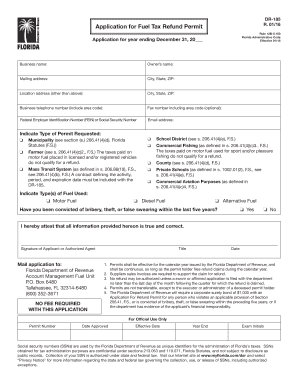

The FL DR-185 form is an application for a fuel tax refund permit in Florida. This guide provides clear and detailed instructions on how to fill out the form online, ensuring a smooth completion process for all users.

Follow the steps to complete the FL DR-185 online effectively.

- Click ‘Get Form’ button to obtain the FL DR-185 form and open it in the document editor.

- Enter the business name in the designated field.

- Provide the owner's name in the appropriate section.

- Fill in the mailing address, including the city, state, and ZIP code.

- If applicable, input the location address, ensuring to include the city, state, and ZIP.

- List the business telephone number, including the area code.

- If desired, include a fax number with the area code (optional).

- Input your Federal Employer Identification Number (FEIN) or Social Security Number in the relevant field.

- Enter an email address for further communication.

- Indicate the type of permit requested by selecting one of the provided options.

- Select the types of fuel used by marking the relevant boxes.

- Answer the question regarding any convictions of bribery, theft, or false swearing within the last five years.

- Confirm that all information provided is true and correct by signing in the designated signature field, including your title and the date.

- Review all entered information for accuracy before submitting.

- Save changes, download, print, or share the completed FL DR-185 form as needed.

Complete your documents online efficiently and ensure your application is submitted correctly.

Related links form

Florida does not require residents to file a personal state tax return since there is no state income tax. This can simplify financial planning for individuals and businesses alike. Nevertheless, if you have business income or other financial matters, it's wise to stay well-informed using valuable resources like FL DR-185.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.