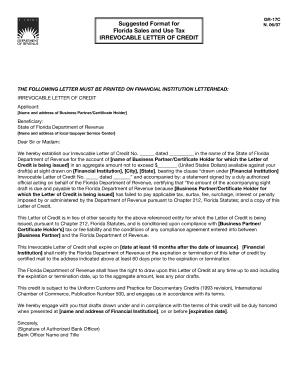

Get Fl Dr-17c 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DR-17C online

How to fill out and sign FL DR-17C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and providing all the necessary tax forms, including FL DR-17C, is the exclusive responsibility of a US citizen.

US Legal Forms makes your tax management substantially more accessible and effective.

Store your FL DR-17C safely. Ensure that all your relevant documents and records are organized properly while keeping in mind the deadlines and tax rules set by the IRS. Simplify the process with US Legal Forms!

- Obtain FL DR-17C in your internet browser from any device.

- Access the fillable PDF document with one click.

- Start filling in the online template field by field, utilizing the prompts of the advanced PDF editor's interface.

- Accurately input text and figures.

- Select the Date field to automatically insert the current day or modify it manually.

- Use Signature Wizard to create your unique e-signature and sign within moments.

- Review Internal Revenue Service guidelines if you still have any uncertainties.

- Click on Done to save your changes.

- Proceed to print the document, save it, or send it via Email, SMS, Fax, USPS without leaving your browser.

How to modify Get FL DR-17C 2007: tailor forms online

Streamline your document preparation workflow and adjust it to your preferences within moments. Complete and endorse Get FL DR-17C 2007 using a robust yet user-friendly online editor.

Document preparation is consistently tedious, especially when you handle it infrequently. It requires strict compliance with all regulations and precise completion of all fields with complete and correct details. However, it frequently occurs that you need to revise the document or insert additional fields to fill out. If you wish to enhance Get FL DR-17C 2007 before submission, the most efficient method is to utilize our powerful yet straightforward online editing tools.

This all-inclusive PDF editing solution enables you to swiftly and effortlessly complete legal documents from any device with internet access, make essential modifications to the template, and incorporate more fillable fields. The service allows you to select a specific area for each type of information, such as Name, Signature, Currency, and SSN, among others. You can designate them as mandatory or conditional and determine who should fill out each section by assigning them to a specific recipient.

Our editor is a flexible multi-functional online solution that can assist you in easily and quickly tailoring Get FL DR-17C 2007 and other templates to meet your requirements. Improve document preparation and submission times while ensuring your paperwork appears professional without complications.

- Access the required template from the catalog.

- Complete the blanks with Text and use Check and Cross tools for the tickboxes.

- Utilize the right-hand toolbar to alter the template with new fillable sections.

- Select the fields based on the type of data you wish to collect.

- Designate these fields as mandatory, optional, or conditional and arrange their sequence.

- Allocate each section to a specific individual using the Add Signer option.

- Confirm that all necessary modifications have been made and click Done.

Get form

Related links form

Calculating the collection allowance in Florida sales tax involves understanding the permitted amount you can retain from the tax collected on sales. You can find this information on the FL DR-17C form, which provides guidance on deductions. Following the instructions correctly ensures that you maximize your allowable retention. Review your calculations carefully to maintain accuracy.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.