Loading

Get Az Form 140 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 140 online

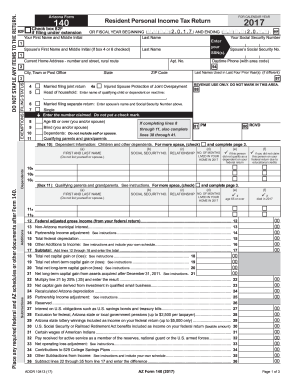

Filling out the AZ Form 140 online is an essential process for Arizona residents preparing their personal income tax returns. This guide offers clear instructions for effectively completing each section of the form to ensure accurate submission.

Follow the steps to accurately fill out your AZ Form 140

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Begin by entering your personal information, including your name, social security number, and current home address. Ensure that the details are accurate and match those on your official documents.

- Indicate your filing status by selecting the appropriate box, such as 'Married filing joint return' or 'Single'. If you are claiming any dependents, list their names and social security numbers in the designated section.

- Complete the income section by reporting all sources of income for the tax year. This includes salary, business earnings, and any other taxable income.

- Fill out the deductions section. Review whether you will take the itemized or standard deduction and enter the correct amount as required.

- Complete any additional sections regarding tax credits applicable to you, such as family income tax credits or overpayment credits.

- Review all entered information for accuracy and completeness. Make sure that calculations are correct to avoid any delays in processing.

- Once you have verified all information, you can save your changes, download a copy for your records, print the form for submission, or share it if needed.

Start filling out your AZ Form 140 online now to ensure a smooth and timely tax return process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Arizona, there is no specific age at which seniors automatically stop paying property taxes. However, seniors aged 65 and older may qualify for property tax rebates or exemptions depending on their income and property status. Completing the AZ Form 140 is a critical step in determining available benefits for senior citizens.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.