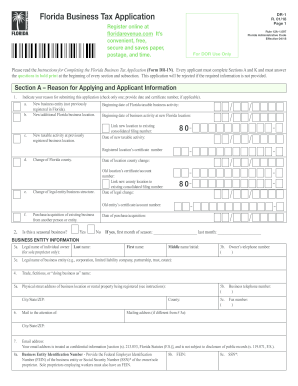

Get Fl Dor Dr-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR DR-1 online

How to fill out and sign FL DoR DR-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your earnings and submitting all essential tax documents, including FL DoR DR-1, is a US citizen's exclusive obligation.

US Legal Forms makes managing your taxes more straightforward and precise.

Safeguard your FL DoR DR-1 securely. Ensure that all your relevant documents and information are organized while being mindful of the deadlines and taxation regulations set by the Internal Revenue Service. Simplify it with US Legal Forms!

- Obtain FL DoR DR-1 from your web browser on your device.

- Access the editable PDF document with a click.

- Start filling out the template field by field, adhering to the prompts of the sophisticated PDF editor's interface.

- Carefully enter text and figures.

- Press the Date box to automatically input the current date or adjust it manually.

- Utilize Signature Wizard to create your personalized e-signature and authenticate in seconds.

- Refer to Internal Revenue Service guidelines if you have any remaining inquiries.

- Click on Done to save the modifications.

- Proceed to print the document, save it, or disseminate it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get FL DoR DR-1 2018: personalize forms online

Experience a hassle-free and digital approach to working with Get FL DoR DR-1 2018. Utilize our dependable online platform and conserve a significant amount of time.

Creating each form, including Get FL DoR DR-1 2018, from the ground up demands considerable effort, so having a reliable system of pre-completed form templates can significantly boost your efficiency.

However, utilizing them can present challenges, particularly with files in PDF format. Luckily, our vast library provides an integrated editor that allows you to effortlessly complete and modify Get FL DoR DR-1 2018 without leaving our site, ensuring you do not spend hours preparing your forms. Here’s what you can accomplish with your form using our tools:

Whether you aim to finish editable Get FL DoR DR-1 2018 or any other form available in our collection, you are on the right track with our online document editor. It is straightforward and secure and does not necessitate advanced skills. Our web-based tool is crafted to manage nearly everything you can think of regarding document editing and completion.

Set aside the traditional methods of managing your documents. Opt for a more effective alternative to streamline your tasks and reduce reliance on paper.

- Step 1. Locate the required form on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Employ our specialized editing capabilities that enable you to add, delete, annotate, and highlight or obscure text.

- Step 4. Create and incorporate a legally-recognized signature to your form by using the signing option from the upper toolbar.

- Step 5. If the form layout doesn’t appear as you wish, use the options on the right to delete, add, and organize pages.

- Step 6. Include fillable fields so that other parties can be invited to complete the form (if necessary).

- Step 7. Share or dispatch the form, print it out, or select the format in which you desire to download the document.

Get form

Related links form

To obtain a tax ID number for your small business in Florida, complete the required forms on the Florida Department of Revenue (FL DoR) website. This number is crucial for tax purposes and must be acquired before conducting business. If you need assistance, platforms like uslegalforms offer services to help streamline the application process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.