Loading

Get Treasury Fs 1010 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury FS 1010 online

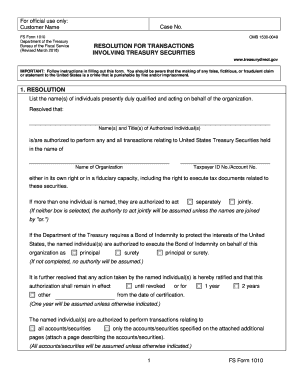

The Treasury FS 1010 form is essential for authorizing individuals within an organization to conduct transactions regarding Treasury securities. This guide will help you navigate the process of completing the form online efficiently and accurately.

Follow the steps to fill out the Treasury FS 1010 online.

- Press the 'Get Form' button to access and open the Treasury FS 1010 form in your editor.

- In the resolution section, list the names and titles of the individuals who are being authorized to perform transactions. Ensure that you include the full legal name of your organization and its taxpayer identification number.

- Indicate whether the authorized individuals can act separately or must act jointly by selecting the appropriate checkbox.

- Specify if the named individuals are authorized to execute a bond of indemnity on behalf of the organization. This step is important for claims related to lost securities.

- Determine how long the authorization will remain valid. Options include 'until revoked' or for a specific duration of either one or two years. Select the appropriate option.

- Indicate whether the authorization applies to all accounts and securities or is restricted to only specific ones. Attach any additional pages if necessary.

- In the authorization section, an officer of the organization, who is not one of the authorized individuals, must sign and date the form. An official seal of the organization must also be affixed.

- If the organization's seal is not available, the certification section must be completed by a certifying officer, who will verify the identity of those who appeared to sign the document.

- Once all fields are accurately filled, save your changes. You may choose to download, print, or share the completed form as needed.

Complete your forms online to ensure a smooth transaction process.

To put your savings bonds into TreasuryDirect, you will need to create an account on their website. Once your account is set up, you can follow the specified procedures to link or transfer your bonds. This allows you to manage your investments online conveniently. For clear instructions on managing your bonds within TreasuryDirect, consider using the support resources available at USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.