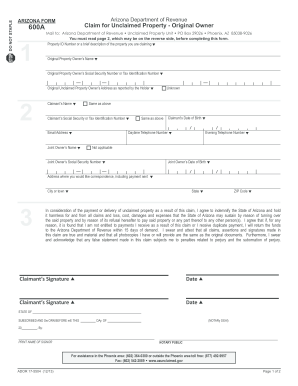

Get Az Dor 600a 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AZ DoR 600A online

How to fill out and sign AZ DoR 600A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period began unexpectedly or you simply overlooked it, it might likely lead to issues for you. AZ DoR 600A is not the simplest form, but there is no reason to panic in any circumstance.

By leveraging our robust solution, you will discover the optimal method to complete AZ DoR 600A in scenarios of significant time constraints. You only need to adhere to these straightforward instructions:

With our powerful digital solution and its helpful features, submitting AZ DoR 600A becomes easier. Don’t hesitate to try it and spend more time on hobbies instead of preparing documents.

- Open the document using our sophisticated PDF editor.

- Input the required information in AZ DoR 600A, utilizing the fillable fields.

- Incorporate images, checkmarks, cross marks, and text boxes as desired.

- Repeated data will be populated automatically after the initial entry.

- If you encounter any challenges, employ the Wizard Tool. It will provide helpful advice for easier completion.

- Always remember to include the application date.

- Create your distinct signature once and place it in the designated areas.

- Review the information you have entered. Amend errors if needed.

- Click Done to complete modifications and choose your method of submission. You can opt for virtual fax, USPS, or email.

- You also have the option to download the file for later printing or to upload it to cloud storage services like Dropbox or OneDrive.

How to Modify Get AZ DoR 600A 2013: Personalize Forms Online

Choose a trustworthy document editing service you can depend on. Modify, execute, and authenticate Get AZ DoR 600A 2013 safely online.

Frequently, dealing with forms such as Get AZ DoR 600A 2013 can be tricky, particularly if you obtained them online or via email and lack access to specialized software. Although you might discover some alternatives to navigate around this, there's a risk of producing a document that won't meet submission standards. Utilizing a printer and scanner isn't a solution either as it's both time-consuming and resource-draining.

We provide a more seamless and effective method for completing documents. A comprehensive collection of document templates that are easy to modify and authorize, to make fillable for others. Our service goes far beyond just a template library. One of the standout benefits of using our service is the ability to alter Get AZ DoR 600A 2013 directly on our website.

Being an online solution, it eliminates the need for any software installation. Moreover, not all company policies allow the installation of software on your corporate device. Here’s the simplest method to effortlessly and securely process your forms using our platform.

Bid farewell to paper and other ineffective approaches for completing your Get AZ DoR 600A 2013 or other documents. Opt for our tool instead, which features one of the most extensive libraries of customizable forms and comprehensive document editing services. It’s simple and secure, and can save you a significant amount of time! Don’t just take our word for it, try it out for yourself!

- Click on Get Form > to be redirected to our editor immediately.

- After opening, start the customization procedure.

- Choose checkmark, circle, line, arrow, and cross among other options to annotate your document.

- Select the date option to incorporate a specific date into your document.

- Insert text boxes, images, and notes to enhance the content.

- Utilize the fillable fields option on the right to insert fillable {fields.

- Select Sign from the top toolbar to create and append your legally-binding signature.

- Press DONE to save, print, share, or retrieve the final {file.

Get form

The main difference between AZ Form 5000 and Form 5000A lies in their intended use: Form 5000 is generally for sales tax exemption, while Form 5000A is specifically for individual income tax exemption related to sales. Each form has unique requirements and purposes. If you seek clarity on these forms, US Legal Forms can provide detailed comparisons and specific instructions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.