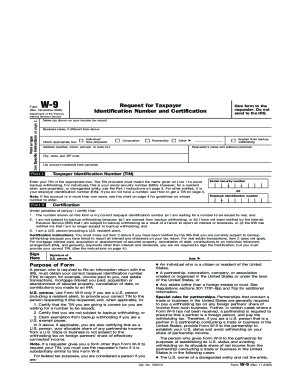

Get Irs W-9 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-9 online

How to fill out and sign IRS W-9 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your earnings and submitting all the essential tax documents, including IRS W-9, is the exclusive responsibility of a US citizen.

US Legal Forms facilitates clearer and more precise tax management.

Keep your IRS W-9 safe. Ensure that all your accurate documents and information are organized while considering the deadlines and tax regulations set by the IRS. Simplify the process with US Legal Forms!

- Access IRS W-9 in your internet browser from any device.

- Click to open the fillable PDF form.

- Begin completing the template field by field, utilizing the guidance of the advanced PDF editor's interface.

- Accurately enter text and numerical data.

- Choose the Date box to set today’s date automatically or modify it manually.

- Use Signature Wizard to create your personalized e-signature and authenticate in a few minutes.

- Consult the IRS instructions if you have further questions.

- Press Done to save your modifications.

- Proceed to print the document, save it, or distribute it via Email, SMS, Fax, USPS without leaving your browser.

How to modify Get IRS W-9 2005: personalize forms online

Complete and endorse your Get IRS W-9 2005 swiftly and without mistakes. Obtain and modify, and endorse customizable form templates within the ease of a single tab.

Your document process can be significantly more effective if everything needed for modifying and managing the workflow is organized in one location. If you are seeking a Get IRS W-9 2005 form example, this is the place to acquire it and complete it without searching for external solutions.

With this smart search engine and editing application, you won’t have to look any further. Just enter the title of the Get IRS W-9 2005 or any other form and discover the appropriate example.

If the example appears pertinent, you can commence editing it instantly by clicking Get form. No requirement to print or even download it. Hover and click on the interactive fillable fields to add your information and endorse the form in a single editor.

Obscure text in the document if desired, or highlight it. Conceal text segments using the Erase, Highlight, or Blackout tool. Integrate custom elements such as Initials or Date utilizing the corresponding tools, which will be generated automatically. Save the form on your device or convert its format to your preferred one. When equipped with a smart forms catalog and an effective document editing tool, managing documentation becomes simpler. Locate the form you need, fill it out right away, and sign it on the spot without downloading it. Streamline your paperwork routine with a solution designed for form editing.

- Utilize additional editing functionalities to personalize your form:

- Activate interactive checkboxes in forms by clicking on them.

- Examine other sections of the Get IRS W-9 2005 form text by employing the Cross, Check, and Circle tools.

- If you need to add more written content into the document, utilize the Text tool or insert fillable fields with the appropriate button. You can even define the content of each fillable field.

- Incorporate images into forms using the Image button. Upload images from your device or capture them using your computer camera.

- Include custom visual elements in the document. Use Draw, Line, and Arrow tools to illustrate on the document.

Get form

Related links form

Calculating tax on income reported via the IRS W-9 involves understanding your total earnings for the tax year. Usually, the income you receive as an independent contractor or freelancer will be subject to self-employment tax. It may be beneficial to consult with a tax professional or utilize tax software to ensure accurate computations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.