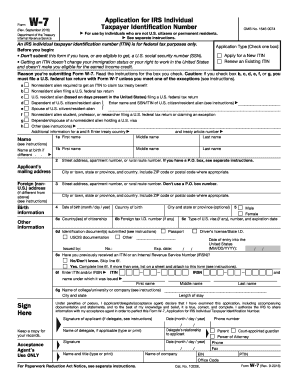

Get Irs W-7 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-7 online

How to fill out and sign IRS W-7 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all essential tax documentation, including IRS W-7, is a sole responsibility of a US citizen. US Legal Forms simplifies your tax management and makes it more convenient and effective.

How to fill out IRS W-7 online:

Keep your IRS W-7 safe. Ensure that all your accurate documents and records are organized while adhering to the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain IRS W-7 on your device's browser.

- Access the fillable PDF form with a click.

- Start completing the template step by step by following the prompts of the advanced PDF editor's interface.

- Carefully enter text and figures.

- Click on the Date field to automatically insert today’s date or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and validate it in minutes.

- Refer to the Internal Revenue Service guidelines if you have further inquiries.

- Press Done to finalize the modifications.

- Proceed to print the document, save it, or send it via Email, SMS, Fax, or USPS without exiting your browser.

How to Modify Get IRS W-7 2012: personalize forms on the internet

Place the correct document management resources at your disposal. Complete Get IRS W-7 2012 with our dependable service that includes editing and eSignature features.

If you wish to execute and sign Get IRS W-7 2012 online effortlessly, then our cloud-based solution is the perfect choice. We offer a vast template library of ready-to-use forms you can modify and complete online.

Moreover, there is no need to print the document or rely on third-party services to make it fillable. All essential tools will be readily accessible as soon as you open the file in the editor.

In addition to the above features, you can secure your file with a password, apply a watermark, convert the file to the preferred format, and much more.

Our editor simplifies the process of completing and certifying the Get IRS W-7 2012. It empowers you to handle all aspects of working with forms. Additionally, we consistently ensure that your file editing experience is secure and complies with key regulatory standards.

All these factors contribute to making our solution even more enjoyable. Obtain Get IRS W-7 2012, apply the necessary modifications and alterations, and download it in the desired file format. Try it out today!

- Revise and annotate the template

- The top toolbar contains tools that allow you to emphasize and obscure text, exclude images and graphic elements (lines, arrows, checkmarks, etc.), add your signature, initial, date the document, and more.

- Arrange your documents

- Utilize the left toolbar if you want to reorder the document or delete pages.

- Create shareable forms

- If you'd like to make the template fillable for others and distribute it, you can use the tools on the right to insert various fillable fields, signature and date, text box, etc.

Get form

The IRS W-7 cannot be submitted electronically; it must be mailed to the IRS. However, you can prepare your application using electronic tools and services to ensure accuracy. Utilizing a platform like USLegalForms can simplify the process and help ensure proper submission.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.