Loading

Get Irs W-3c 2015-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3C online

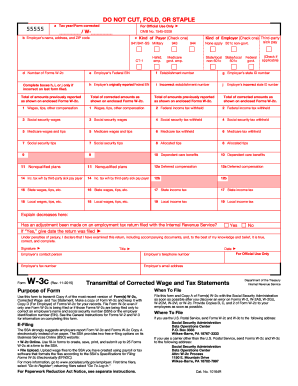

Filling out the IRS W-3C form online is essential for transmitting corrected wage and tax statements accurately. This guide will provide you with detailed, step-by-step instructions to ensure that you complete the form correctly.

Follow the steps to complete the IRS W-3C online.

- Press the ‘Get Form’ button to download the W-3C form and open it in your editor.

- In part a, indicate the tax year for the corrections by entering the appropriate year next to 'Tax year/Form corrected.'

- For part b, provide the employer's name, address, and ZIP code accurately to ensure the documentation is correctly attributed.

- In part c, check off the kind of payer under the 'Kind of Payer' section that applies to your situation.

- In part d, enter the total number of Forms W-2c being transmitted.

- In part e, input your employer's Federal Employer Identification Number (EIN). Double-check for accuracy.

- If applicable, include the establishment number in part f and the employer's state ID number in part g.

- If this is a correction of previously reported figures, complete boxes h, i, and j with the incorrect information from the last filed W-2.

- Fill out the compensation amounts in sections 1 through 19 as necessary, ensuring all amounts match those reported on the Forms W-2c.

- At the end of the form, sign and provide your title, date, and contact information to confirm the declaration.

- After ensuring all information is accurate, save your changes. You can download, print, or share the completed form as needed.

Begin your online filing process for the IRS W-3C now.

The W-3 format is a summary document that accompanies the W-2 form when reporting income to the IRS. It is structured and must include information such as total wages and tax amounts for all employees. Following the specified format ensures that the IRS recognizes your submission, which is vital for accurate tax records. Use UsLegalForms to access templates and resources that help you complete it correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.