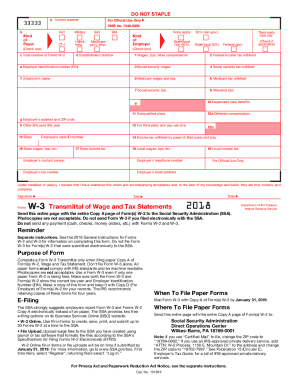

Get Irs W-3 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-3 online

How to fill out and sign IRS W-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Validating your income and submitting all crucial tax documentation, including IRS W-3, is a US citizen's exclusive responsibility. US Legal Forms facilitates making your tax management more clear and effective.

Here's how to fill out IRS W-3 online:

Store your IRS W-3 securely. Ensure that all your relevant documentation and information are organized while being mindful of the deadlines and tax regulations stipulated by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Access IRS W-3 in your browser from any device.

- Click to get the editable PDF file.

- Start filling the template step by step, adhering to the guidance of the advanced PDF editor's interface.

- Precisely input text and figures.

- Press the Date field to automatically set today's date or edit it manually.

- Utilize Signature Wizard to create your personal e-signature and authenticate in minutes.

- Refer to the Internal Revenue Service instructions if you have additional questions.

- Click Complete to finalize the modifications.

- Proceed to print the document, download it, or send it via email, SMS, fax, or USPS without leaving your browser.

How to Modify Get IRS W-3 2018: Personalize Forms Online

Streamline your document preparation procedures and tailor it to your specifications in just a few clicks. Complete and finalize Get IRS W-3 2018 using a powerful yet user-friendly online editor.

Dealing with documentation is always a challenge, especially if you only handle it occasionally. It requires you to meticulously follow all regulations and accurately fill in all sections with complete and precise details. However, it often occurs that you need to alter the form or add additional sections to complete. If you wish to enhance Get IRS W-3 2018 before submission, the most effective approach is to utilize our robust yet easy-to-use online editing tools.

This extensive PDF editing tool enables you to effortlessly and swiftly complete legal documents from any device connected to the internet, make essential adjustments to the form, and incorporate more fillable sections. The service allows you to select a specific area for each data type, such as Name, Signature, Currency, and SSN, etc. You can designate these fields as mandatory or conditional and identify who is responsible for filling out each section by assigning it to a particular recipient.

Our editor is a flexible, multifunctional online tool that can assist you in easily and quickly adjusting Get IRS W-3 2018 along with other forms to suit your preferences. Enhance document preparation and submission efficiency while ensuring your forms appear professional without any complications.

- Access the necessary template from the library.

- Fill in the gaps with Text and use Check and Cross tools for the tickboxes.

- Utilize the right-hand panel to modify the template with new fillable fields.

- Choose the areas based on the type of information you want to gather.

- Make these fields mandatory, optional, or conditional, and arrange them as needed.

- Assign each field to a specific individual using the Add Signer tool.

- Ensure that all required changes are made and click Done.

Get form

To fill out a third-party authorization form, you must provide basic details about yourself and the third party, including names and contact information. You should also specify what information the third party can access regarding your tax matters. This authorization is important if you want someone else to handle communications with the IRS on your behalf. Tools from US Legal Forms can simplify this process by offering templates that guide you through each step.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.