Loading

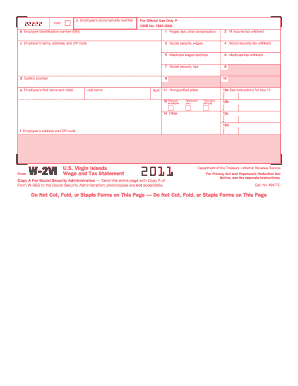

Get Irs W-2vi 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2VI online

Filling out the IRS W-2VI online can seem daunting, but this guide provides a straightforward approach to completing the form accurately. By following the step-by-step instructions, users can ensure that all necessary information is incorporated effectively.

Follow the steps to successfully fill out the IRS W-2VI online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the employee’s social security number in box a. This number is critical for tax records and should be entered accurately.

- Provide the employer identification number (EIN) in box b. This identifier allows the IRS to match the form to the employer's tax records.

- Complete section c by entering the employer’s name, address, and ZIP code.

- Fill in box 1 with the total amount of wages, tips, and other compensation that the employee received throughout the year.

- In box 2, indicate the total amount of Virgin Islands (VI) income tax withheld from the employee’s pay.

- Complete box 3 with the total social security wages that are subject to social security tax.

- Enter the total amount of social security tax withheld in box 4.

- In box 5, provide the total Medicare wages and tips. This includes all wages subject to Medicare tax.

- Indicate the total Medicare tax withheld in box 6.

- Complete box 7 with the amount of social security tips the employee reported.

- Use box 8 to indicate any statutory employee status, if applicable.

- In box 9, enter the control number if your employer has assigned one.

- Enter the employee's first name, middle initial, and last name in box e.

- Provide any applicable suffix in the suff field if it applies to the employee’s name.

- Complete box f by entering the employee’s address and ZIP code.

- Fill in box 11 to report any amounts related to nonqualified plans as necessary.

- In box 12, provide any applicable codes for various deductions, contributions, or other reportable items.

- Make sure all information is accurate and review the form thoroughly to avoid any errors.

- Once completed, save changes, and proceed to download or print the form as required for distribution and record-keeping.

Complete your IRS W-2VI form online today to ensure accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you need an old W-2, the best approach is to contact your former employer for a reissue of your IRS W-2VI. In case your employer is unreachable, you can request a transcript from the IRS, which contains the information from your W-2. The US Legal Forms platform provides useful templates and guidance to help you request these documents with ease, ensuring you have the paperwork needed for your records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.