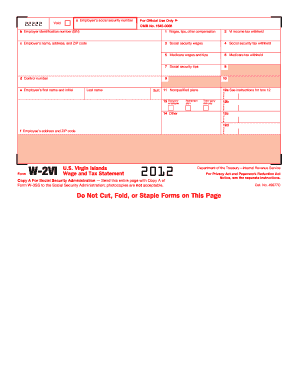

Get Irs W-2vi 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-2VI online

How to fill out and sign IRS W-2VI online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Declaring your earnings and completing all necessary tax documents, including IRS W-2VI, is the exclusive responsibility of a US citizen.

US Legal Forms facilitates the ease and accuracy of your tax management. You can locate any legal documents you need and complete them electronically.

Safeguard your IRS W-2VI. Ensure that all essential documents and information are appropriately organized while keeping in mind the deadlines and tax regulations set by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain IRS W-2VI using your web browser from your device.

- Access the editable PDF file with a single click.

- Start filling in the online template field by field, following the instructions of the sophisticated PDF editor's interface.

- Enter text and numbers correctly.

- Click on the Date field to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to generate your unique e-signature and sign within seconds.

- Consult the Internal Revenue Service guidelines if you still have questions.

- Select Done to preserve the changes.

- Proceed to print the document, save it, or share it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get IRS W-2VI 2013: personalize forms online

Authorize and disseminate Get IRS W-2VI 2013 along with additional business and personal documents online without squandering time and resources on printing and mailing. Maximize the use of our online document editor equipped with a built-in compliant eSignature tool.

Authorizing and submitting Get IRS W-2VI 2013 documents digitally is quicker and more effective than handling them on paper. Nevertheless, it necessitates utilizing online solutions that ensure a high level of data security and furnish you with a certified tool for generating eSignatures. Our robust online editor is exactly what you need to finalize your Get IRS W-2VI 2013 and other personal and business or tax templates accurately and appropriately in accordance with all stipulations. It provides all the essential tools to effortlessly and swiftly complete, modify, and endorse paperwork online and add Signature fields for others, specifying who and where needs to sign.

It only requires a few straightforward steps to finalize and endorse Get IRS W-2VI 2013 online:

Distribute your document with others using one of the available methods. When endorsing Get IRS W-2VI 2013 with our all-inclusive online solution, you can always be confident it is legally binding and admissible in court. Prepare and submit your documents in the most effective manner possible!

- Access the chosen file for additional handling.

- Utilize the top panel to insert Text, Initials, Image, Check, and Cross indicators to your document.

- Highlight the crucial aspects and obscure or eliminate the sensitive ones if needed.

- Select the Sign tool above and decide how you wish to eSign your document.

- Sketch your signature, type it, upload its image, or select an alternative method that fits you.

- Navigate to the Edit Fillable Fields panel and place Signature areas for others.

- Click on Add Signer and provide the recipient’s email to assign this field to them.

- Ensure that all provided information is complete and precise before clicking Done.

Get form

Related links form

It's recommended to paperclip your IRS W-2VI to your tax return rather than stapling it. This helps keep the documents together without damaging them. Properly attaching your W-2 ensures it can be easily processed by the IRS. Leave a little space in the clip for the documents to breathe, so they remain easy to handle.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.