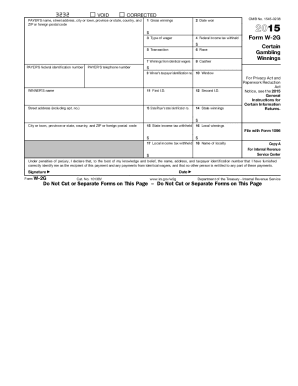

Get Irs W-2g 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-2G online

How to fill out and sign IRS W-2G online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Declaring your earnings and submitting all the essential tax paperwork, including IRS W-2G, is the exclusive responsibility of a US citizen.

US Legal Forms simplifies your tax management process, making it more accessible and efficient.

Safeguard your IRS W-2G securely. Ensure that all your accurate documents and information are organized while being mindful of the deadlines and tax mandates established by the IRS. Simplify the process with US Legal Forms!

- Obtain IRS W-2G on your device's browser.

- Access the editable PDF document with a click.

- Start completing the template step by step, following the instructions of the advanced PDF editor’s interface.

- Carefully input text and numbers.

- Click the Date field to automatically insert the current date or modify it manually.

- Utilize Signature Wizard to create your personalized electronic signature and authenticate instantly.

- Consult the Internal Revenue Service guidelines if you still have questions.

- Press Done to save the modifications.

- Continue to print the document, download it, or send it via E-mail, SMS, Fax, or USPS without leaving your web browser.

How to alter Get IRS W-2G 2015: personalize forms online

Experience a hassle-free and paperless method of updating Get IRS W-2G 2015. Utilize our reliable online service and conserve a significant amount of time.

Creating every document, including Get IRS W-2G 2015, from the ground up demands excessive effort, so utilizing a dependable platform of pre-loaded form templates can substantially enhance your efficiency.

However, modifying them can be difficult, especially regarding documents in PDF format. Fortunately, our vast library features a built-in editor that enables you to swiftly fill out and personalize Get IRS W-2G 2015 without exiting our site, allowing you to avoid wasting your valuable time handling your paperwork. Here’s what to do with your file using our tools:

Whether you need to process editable Get IRS W-2G 2015 or any other template in our catalog, you’re effectively on track with our online document editor. It’s simple and secure and doesn’t necessitate any special expertise. Our web-based solution is designed to manage practically everything you might consider when it comes to document editing and execution.

Forget about the conventional way of dealing with your documents. Opt for a more efficient solution to help you streamline your tasks and make them less reliant on paper.

- Step 1. Find the necessary form on our platform.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize professional editing tools that facilitate the insertion, removal, annotation, and highlighting or redaction of text.

- Step 4. Create and apply a legally-binding signature to your document using the sign option from the upper toolbar.

- Step 5. If the template layout doesn’t appear as you require, use the tools on the right to delete, add, and rearrange pages.

- step 6. Incorporate fillable fields so that other individuals can be invited to complete the template (if applicable).

- Step 7. Distribute or send the form, print it, or choose the format in which you would like to download the document.

Get form

If you lost your W-2, you can often retrieve a replacement directly from your employer online if they provide an online payroll service. Additionally, you can access your IRS W-2G through the IRS's Get Transcript tool, which can help you recover lost forms easily.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.