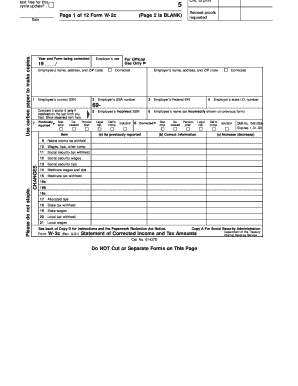

Get Irs W-2c 1991

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-2C online

How to fill out and sign IRS W-2C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your earnings and submitting all the essential tax documents, including IRS W-2C, is a responsibility exclusive to US citizens.

US Legal Forms simplifies your tax management by making it more straightforward and accurate.

Safeguard your IRS W-2C securely. Ensure that all your accurate documents and information are properly organized while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Make it easy with US Legal Forms!

- Access IRS W-2C in your web browser from your device.

- Obtain the fillable PDF file with a single click.

- Start completing the template field by field, following the prompts of the advanced PDF editor's interface.

- Carefully enter text and numbers.

- Click the Date box to automatically set the current date or adjust it manually.

- Use the Signature Wizard to create your personal e-signature and validate in minutes.

- Consult the IRS guidelines for any lingering questions.

- Press Done to save your changes.

- Proceed to print the document, download it, or send it via email, text message, fax, or USPS without leaving your browser.

How to modify Get IRS W-2C 1991: personalize forms online

Take advantage of the functionality of the feature-rich online editor while completing your Get IRS W-2C 1991. Utilize the array of tools to swiftly fill in the blanks and submit the required information promptly.

Creating documents can be laborious and costly unless you have pre-prepared fillable forms and finalize them digitally. The easiest method to handle the Get IRS W-2C 1991 is to utilize our professional and feature-rich online editing tools. We provide you with all the crucial instruments for quick form completion and allow you to modify your templates according to any specifications. Additionally, you can comment on the changes and leave notes for others involved.

Here’s what you can accomplish with your Get IRS W-2C 1991 in our editor:

Handling the Get IRS W-2C 1991 in our comprehensive online editor is the quickest and most effective approach to organize, submit, and share your paperwork as you require from anywhere. The tool functions from the cloud, enabling access from any location on any internet-enabled device. All templates you create or finalize are securely stored in the cloud, allowing you to access them whenever necessary and ensuring you won’t lose them. Stop wasting time on manual document preparation and eliminate paperwork; accomplish everything online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize key details with a preferred color or underline them.

- Conceal sensitive information using the Blackout feature or simply delete them.

- Incorporate images to illustrate your Get IRS W-2C 1991.

- Replace the original wording with text that meets your needs.

- Include comments or sticky notes to discuss updates with others.

- Create extra fillable sections and assign them to particular individuals.

- Secure the document with watermarks, date stamps, and bates numbers.

- Distribute the document in multiple ways and save it on your device or in the cloud in various formats upon completion.

Get form

The 2C form, or IRS W-2C, is a correction form used to amend previously filed W-2 forms. It helps taxpayers report changes in wages, withholdings, or any other discrepancies accurately. If you have errors in your tax reporting, using the IRS W-2C can help ensure that your information is up-to-date. By doing so, you maintain compliance and avoid issues with the IRS.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.