Get Irs W-2c 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2C online

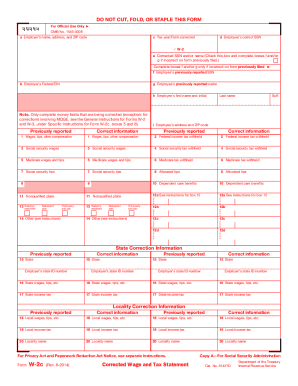

Filling out the IRS W-2C, the Corrected Wage and Tax Statement, is essential for accurately reporting corrections to previously submitted W-2 forms. This guide will provide clear, step-by-step instructions tailored to ensure users can complete the form online with confidence.

Follow the steps to accurately complete the IRS W-2C online.

- Click 'Get Form' button to obtain the W-2C form, ensuring it opens in an editable format.

- In section a, enter the employer's name, complete address, and ZIP code. This information is crucial for identification purposes.

- In section b, input the employer's Federal Employer Identification Number (EIN). Ensure this number is accurate.

- In section c, specify the tax year or indicate which form is being corrected. This highlights the relevant period for the corrections made.

- In section d, enter the employee's correct Social Security Number (SSN). This is vital to associate the corrections with the right individual.

- If there is an error in the employee's SSN or name, check box e and fill out the previously reported information in sections f and g.

- In section h, provide the employee’s first name, initial, last name, and any applicable suffix.

- In section i, enter the employee’s address and ZIP code, ensuring accuracy for record-keeping.

- Proceed to the money fields (sections 1 to 19). Fill in any previously reported amounts and provide the corrected amounts as necessary, referring to the original form.

- After completing all relevant corrections, review the form for accuracy. Make sure all changes are clear and correctly documented.

- Finally, save your changes. You can then download, print, or share the completed form as needed.

Ensure accurate tax reporting by filling out your W-2C online today.

The easiest way to get a W-2 is to request it directly from your employer at the end of each tax year. Employers typically provide copies of W-2s by January 31, and you can ask for an electronic or paper version. If you've lost your W-2 or need a copy for past years, you might consider filing Form W-2C with the IRS for corrections. Platforms like USLegalForms provide guidance to streamline this process and help you secure your IRS W-2C swiftly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.