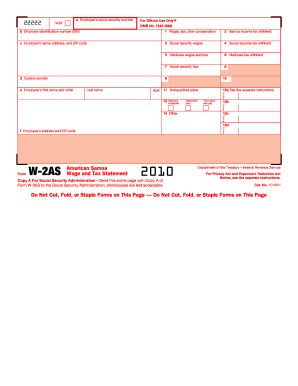

Get Irs W-2as 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

The IRS W-2AS form is an essential document for reporting wages and taxes withheld for employees in American Samoa. Filling it out accurately ensures compliance with federal and local tax requirements. This guide provides a step-by-step approach to help users complete the IRS W-2AS online with confidence.

Follow the steps to fill out the IRS W-2AS online effectively.

- Click the ‘Get Form’ button to access the W-2AS form and open it for editing.

- Begin by entering the employee's social security number in box 'a'. This identifier is critical for tax reporting.

- In box 'b', input the employer identification number (EIN), which uniquely identifies the employer.

- Provide the employer's name, address, and ZIP code in box 'c'. This information clearly identifies the source of the form.

- Document wages, tips, and other compensation received by the employee in box '1'. This figure indicates the total taxable income.

- Enter the amount of Samoa income tax withheld in box '2'. This ensures accurate tax records.

- Fill in box '3' with social security wages, which reflect the amount of earnings subject to social security tax.

- Record the amount of social security tax withheld from the employee's wages in box '4'.

- For Medicare wages and tips, enter the total in box '5'. This figure represents earnings subject to Medicare tax.

- Enter the Medicare tax withheld in box '6'. This is an important aspect of documenting health care contributions.

- If applicable, document any social security tips received in box '7'. Include this for thorough reporting.

- Complete box 'e' with the employee's first name, initial, and last name to ensure proper identification.

- Enter the employee’s address and ZIP code in box 'f' for accurate communication and record-keeping.

- After completing all necessary fields, review the information for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete and file your IRS W-2AS form online to stay compliant with tax regulations.

Get form

Related links form

If you fill out your W-4 incorrectly, you might either overpay or underpay your taxes. Overpaying leads to smaller paychecks, but results in a refund later, while underpaying can cause tax bills and penalties when you file your return. To avoid such pitfalls, consider utilizing resources like US Legal Forms, which can help ensure your W-4 aligns correctly with IRS W-2AS requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.