Loading

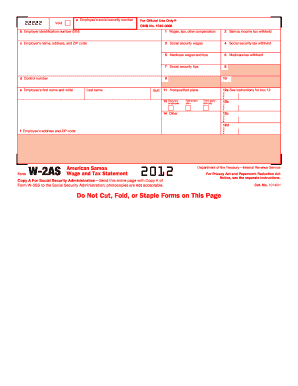

Get Irs W-2as 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

Completing the IRS W-2AS form online can streamline the process of reporting wages and tax information accurately. This guide will walk you through each section of the form, ensuring you understand the requirements and can fill it out correctly.

Follow the steps to complete your IRS W-2AS form online.

- Click ‘Get Form’ button to access the IRS W-2AS form in the editor. This action allows you to start your filing process.

- In Box a, enter the employee’s social security number. Make sure to double-check the digits to avoid any errors.

- In Box b, input the employer identification number (EIN). This number is crucial for identifying your business.

- For Box c, provide the employer’s name, address, and ZIP code. Ensure that the information is accurate and matches official records.

- In Box 1, report the total wages, tips, and other compensation the employee received during the year.

- Box 2 requires the amount of Samoa income tax withheld from the employee's earnings.

- Complete Box 3 by entering the total social security wages, which may differ from the total compensation reported in Box 1.

- In Box 4, indicate the total social security tax that has been withheld from the employee.

- Box 5 requires the amount of Medicare wages and tips the employee received.

- List the Medicare tax withheld from the employee's wages in Box 6. This amount is vital for Medicare funding.

- Enter any social security tips reported by the employee in Box 7, if applicable.

- Next, complete any relevant codes in Box 12. This may include details about retirement plans or nonqualified plans, as specified by instructions.

- In Box 13, check the boxes that apply regarding the statutory employee status or retirement plan participation.

- Finally, fill in the employee’s first name, last name, and address in Box e and f respectively, ensuring all details are accurate.

- Once all sections are completed, save your changes. You can also download or print the form, or share it as needed.

Start filling out your IRS W-2AS form online today for a smooth and efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain an old W-2, you should first contact your previous employer to request a copy. Employers are required to keep these records for a certain number of years, so they may still have your IRS W-2AS on file. If you encounter difficulties, consider using the uslegalforms platform, which can help you in your efforts to retrieve old tax documents quickly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.