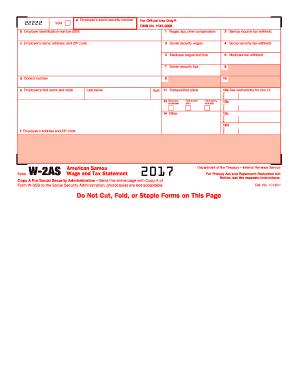

Get Irs W-2as 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

Filling out the IRS W-2AS form is crucial for employers in American Samoa to report wages and taxes for their employees. This guide provides step-by-step instructions on how to complete the form online, ensuring you meet your filing obligations accurately and efficiently.

Follow the steps to fill out the IRS W-2AS online.

- Click ‘Get Form’ button to obtain the W-2AS form and open it in your preferred editor.

- Enter the employee’s Social Security number in the designated field labeled 'a'. This is a critical piece of information for tax reporting.

- Input the employer identification number (EIN) in field 'b'. This number identifies your business for tax purposes.

- Fill in the employer's name, address, and ZIP code in section 'c'. Be sure that the details are accurate to avoid any issues.

- Complete box 1 by entering the total wages, tips, and other compensation paid to the employee for the year.

- In box 2, input the total Samoa income tax withheld from the employee’s earnings.

- Record the social security wages in box 3, which should reflect the wages subject to social security tax.

- Enter the amount of social security tax withheld in box 4, calculated based on the social security wages.

- In box 5, provide the total Medicare wages and tips paid to the employee, which encompasses all earnings.

- Fill in box 6 with the total Medicare tax withheld. This amount is calculated based on the Medicare wages.

- Input the social security tips in box 7, if applicable.

- Complete any additional required sections such as box 11 for nonqualified plans, box 12 for various codes, and the employee’s address in section 'f'.

- After completing all fields accurately, ensure to review the information for any errors.

- Save your changes, and choose to download, print, or share the completed form accordingly.

Ensure compliance and accuracy by completing your IRS W-2AS form online today.

Get form

If you need an old W-2, the quickest approach is to contact your previous employer, as they should be able to issue a duplicate. If your employer is unreachable, you can request a copy from the IRS by filling out Form 4506-T, which can help you obtain your IRS W-2AS for past years. Alternatively, utilize services like US Legal Forms to access resources that simplify the retrieval of your old W-2s, making your tax prep process smoother.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.