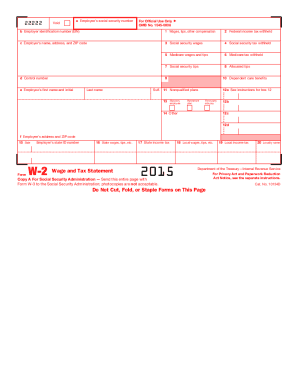

Get Irs W-2 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2 online

Filling out the IRS W-2 form online can be a straightforward process if you understand each component and its requirements. This guide provides a comprehensive overview to assist users, regardless of their experience with tax documentation.

Follow the steps to complete your IRS W-2 form with ease.

- Click ‘Get Form’ button to access the W-2 form and open it in the editor.

- In box a, enter the employee's social security number. Ensure accuracy as this information is critical for tax identification.

- In box b, input the employer identification number (EIN), which serves as the employer's tax ID.

- Provide the employer’s name, address, and ZIP code in box c, ensuring all details are correct and up to date.

- Report the total wages, tips, and other compensation in box 1. This figure should reflect the gross income for the year.

- In box 2, enter the federal income tax withheld from the employee's paycheck throughout the year.

- For boxes 3 and 5, fill in the social security wages and Medicare wages/tips, respectively, as specified by the employee's earnings.

- Complete boxes 4 and 6 with the corresponding amounts of social security tax and Medicare tax withheld.

- Boxes 7 and 8 are for reporting social security tips and allocated tips, which may apply for employees who received tips as part of their compensation.

- Detail any dependent care benefits in box 10 and designate any amounts from nonqualified plans in box 11.

- For box 12, report various codes indicating specific information regarding employee benefits and other compensation data.

- Ensure boxes 15 to 20 for state and local tax information are completed correctly, including state wages and taxes.

- Once all fields are accurately filled out, finalize the document by saving the changes. You can then download, print, or share the completed form as required.

Start filling out your IRS W-2 online now for a smooth and efficient tax filing experience.

Get form

Related links form

You can access your IRS W-2 through your employer's payroll system, which may provide online access to your tax documents. Additionally, many employers send out physical copies of the IRS W-2 by mail, so it's worth checking your mailbox if tax season is approaching. If you face challenges accessing your form, USLegalForms offers a solution by assisting you in ordering copies of your IRS W-2 quickly. This way, you can ensure your tax filing goes smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.