Loading

Get Irs W-10 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-10 online

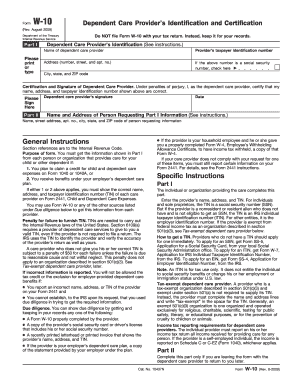

The IRS W-10 form is essential for individuals or organizations that provide care for dependents. This guide will walk you through the process of accurately filling out the W-10 form online, ensuring you understand each section and can complete it effectively.

Follow the steps to complete your IRS W-10 form online.

- Click ‘Get Form’ button to access the W-10 form and open it in your document processor.

- In Part I, provide the dependent care provider's identification details. Enter the name of the provider in the designated field. Ensure you print or type this information for clarity.

- Next, input the provider's taxpayer identification number (TIN) in the appropriate section. If the TIN is a social security number, check the box provided next to it.

- Complete the address section by entering the provider's street address, apartment number (if applicable), city, state, and ZIP code for accurate record keeping.

- Certify the information by having the dependent care provider sign and date the form in Part II. This confirms that all details entered are accurate under penalties of perjury.

- In Part II, fill out the name and address of the person requesting Part I information. This should include your full name, street address, and city, state, and ZIP code.

- Once all fields are filled out, save your changes to keep a digital copy. You may also print the form for your records or share it as needed.

Complete your IRS W-10 form online today to ensure you have the necessary documentation for tax purposes.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can conveniently access IRS tax forms, including the W-10, directly from the official IRS website. Additionally, platforms like US Legal Forms offer easy access to a variety of IRS forms. Using these resources makes it simpler to get the forms you need for your tax filing process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.